Qamar Zaman*

*The writer is a civil servant belonging to Commerce and Trade Group. Presently, he is posted as Joint Secretary (IRC), in Cabinet Division, Islamabad.

Abstract

(After World War II, the world has moved toward freer trade. Countries have made cautious efforts to remove barriers (tariffs, non-tariff barriers, SPS etc.) and, resultantly, international trade has grown faster than world Gross Domestic Production (GDP). Initially the General Agreement on Tariff and Trade (GATT) and later the World Trade Order (WTO) played a significant role in lowering these trade barriers. In addition, international organizations like the International Monetary Fund (IMF), and World Bank (WB) have also championed the same mantra. The US led this cause as well and had been vocal in favor of free trade. Despite facing strong resistance from local manufacturers, the US maintained its position on various occasions 1.

Some economists term international trade as an ‘Engine of Growth’ as it has helped a large number of countries to come out of poverty 2. Still, this agenda has primarily been led by the rich economies of the world. On the flipside, international trade has increased income disparities between countries, which has led to a rise of populist movements. We also witnessed a major shift in the United Kingdom in 2016, once the UK voted to leave the European Union (EU) in the aftermath of the Brexit referendum in 2016. The negotiations that have followed for an exit deal have created a substantial amount of confusion and an atmosphere of uncertainty. Furthermore, during his presidential campaign, President Trump had repeatedly accused China of stealing American jobs (Schuman, 2016). In order to save this, he promised to pursue antitrade policies and would renegotiate the existing trade deals.

In July, 2018, President Trump imposed punitive tariffs on Chinese imports worth $250 billion and threatened with additional tariffs amounting to $ 325 billion (Koty, 2019). He also advised US companies to relocate their production bases from china to the US to protect the domestic economy and create jobs for the American people. These measures have affected the economies of both countries. Not only this, but domestic industry in the US has also criticized policies of its government on multiple grounds – more specifically, on the pretext that the US has substantial Foreign Director Investment (FDI) in China and business interests of hundreds of US companies are at stake now. Presently, Apple, Nike and 18 other US companies have investment of $158 billion in China (Doorn, 2018). These financial flows between economies symbolize the interconnectedness of the world economy. Additionally, multinational corporations of USA have been outsourcing their production processes, often to Chinese vendors, to reduce costs and thus helping in strengthening the global value chain.

An effort has been made to analyze these aspects and what has been the role of different stakeholders (multinational companies) in resolving/ exacerbating this trade war, as US-China trade and investment relations globally impact production, movement of goods and services. – Author)

Scope of Study

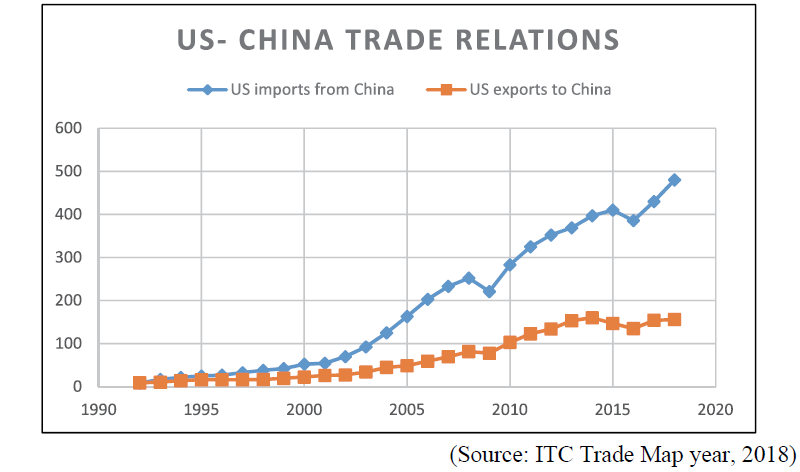

The scope of this study covers the decades old US-China investment and trade relations. China was practically closed for the outside world till 1978-79. It started liberalizing its economy during the rule of Premier Deng Xiaoping – this helped China attract investment in practically all fields. Initially, availability of cheap labour and market size attracted foreign companies. US companies were amongst the first to take advantage of this. They primarily entered into joint ventures – considering this a safer option. Till, 1992, US exports to China were more than their imports. It was only in 1993 that China gained a trade surplus. It has not looked back since then; rather the trade gap in favour of china has been steadily widening. Now, it stands at $ 324 billion (2018). The contribution of US companies in this remarkable progress included: investment (FDI), transfer of technology, helping Chinese in exploring other markets, job creation and even exporting finished products back to the US. China is also one of the largest markets for some of the leading US MNE’s who have made substantial profits in the country. With this background, the US, in July 2018, imposed punitive tariffs which made imports from China less viable. This trade protection has assisted US companies in some industries to gain certain level of advantage, but at the cost of the consumer’s advantage. This has also created surplus supplies in China, especially in steel and aluminium sectors.

In addition, this study also takes into account domestic political and economic reasons – the populist perspective that compelled President Trump to impose punitive tariffs on Chinese imports. The US has also frequently accused China of violating intellectual property laws, stealing industrial secrets and adapting industrial policies with inbuilt export subsidies that provide an undue advantage to its industries. At the end, some possible implications of this trade war for Pakistan will be also be touched upon.

Literature Review

USA and China are leading world economies. Economic ties between the two countries were almost nonexistent till 1970s. Their economies were also different at that point in time. In the late 1970s and thereafter China initiated market reforms and opened its market to other countries. USA was one of the first to take advantage of these reforms. Since then China’s economy has grown exponentially. Till 1992, the trade balance was in favour of USA. Since then, however, it has tilted in favour of China – and this trade gap has been widening, to the unrest of the Americans (Beinart, 2019). Siby and Arunachalam (2018) discussed the historical background of this trade and argued that China was considered a threat to US economic supremacy by various US governments much before President Trump imposed punitive tariffs.

The authors have analyzed the historical context of US-China Trade, its burgeoning deficit in favour of China and its impact on US politics with the ascendancy of nationalist populists. The authors have also briefly touched upon the idea that US companies have greatly assisted China to develop by offering technology and capital; and integration through joint ventures has not only benefitted the US economy but has been an important factor in global economic growth. Morrison (2019) talked about the growing violations of China on patents, copy rights and intellectual property.

Some writers have extensively written about China and how it has transformed its economy by shifting from labour intensive production to high-tech production within the global value chain 3. Some have predicted the decline in China’s economic growth rate and the possibility of a crash. While other notable economists have predicted that China’s technological sophistication is about to catch up to the level of most advanced industrial nations (Yusuf, 2007). Studies also reveal how china is fast becoming well entrenched in the global value chain as importer of ‘parts and components’ and exporter of assembled products as was the case with many US companies who capitalized on the comparative advantage of China (C.F, 2006). Current trends also indicate that China is the biggest spender in the world on research of Artificial Intelligence and modern technologies. As a result it is highly likely that the trade gap between the two countries will continue to expand (Andriole, 2018). Some authors have also analyzed the imposition of the punitive tariffs and have concluded that these tariffs may also fail to bring about the desired result (Feenstra, 2010). There have been some voices in the US, that have been pressing the government to value the economic relation with China in a more constructive way rather than from a threat perspective (Stephen S Roach, 2012). Dr. Steinbock (2016) emphasized that growth of China must be reassessed as an opportunity and China has played its role in trade and world integration in the form of BRICS 4 and One Belt One Road (OBOR). He also emphasized that there was a need for other countries to emulate the example of China for the collective good of the world community. In Kogut’s model of multinationals, one of three sources of wealth is the cost saved through joint venture projects. The second source of wealth is the ability of multinationals to obtain information. Multinationals spend enormous amounts to understand global markets, recruit internationally skilled personnel and analyze social and political environments. US companies, for instance, were among the first to invest in China after it opened up to the world. They took advantage of being pioneers in this initiative and developed a resource base of the political realities of china, its legal system and socio cultural values. They also gathered vital business information such as sources of material and financing, distribution channels, labour management relationships, etc. (Zander, 2003). China, on the other hand, also encouraged foreign companies. They offered incentives/ preferential treatment (better than what was given to local companies) to foreign investors 5. The final stage is the availability of options that provide multinationals discretionary choices of altering real economic activities or financial flows from one country to another.

Research Methodology

A mixed research method has been adapted for this study, which includes interviews from some of the primary sources, who were the beneficiaries of US investment in China (steel and aluminium sector). Most of the questions posed to these primary sources were open ended and an interview-based technique was adapted. Cautious effort was made to make the interviewees comfortable, so that they could express their thoughts openly and candidly.

In addition, a large segment of the research is based on secondary sources in the shape of books, articles, news items, research journals and independent writers’ views on this subject. Data (in the form of documents, observations/perceptions, opinions, beliefs) was collected from diverse sources. This data was consolidated and analyzed and conclusions were drawn accordingly using thematic and narrative analysis techniques and approaches. The period researched was 1980 onwards – once China liberalized its investment and trade regime – therefore, various data sources, including websites maintaining trade and investment data, were frequently consulted. Some informal interviews of various Chinese involved in the business of steel and aluminium have been extremely helpful in understanding the impact of these tariffs on the domestic industry. Some experts are of the view that tariffs are helping China to develop basic industries and hence achieving diversification 6.

Various discussions have also been held with trade experts to solicit their opinion regarding this trade war and what could be the likely ramifications for Pakistan 7. The US has recently withdrawn exemptions granted to India on various products including textiles, agriculture, leather and auto parts due to the failure of India to open its market for US products. An effort has been made to analyze this aspect as well.

US-China Trade: historical context

Since the establishment of US-China diplomatic relations, economic and trade relations between the two countries have developed immensely. Presently, China’s largest export market is the US with exports worth $ 480 billion (ITC, 2019). China has been enjoying a trade surplus with USA since 1993. This has widened to $ 324 billion in 2018, whereas the overall trade surplus of China was $ 361 billion in the same year – meaning thereby that China derived 90% of its trade surplus from the US. Conversely, USA is the fourth largest import destination for the Chinese with the import volume of US $ 156 billion. The major products imported by USA from China are electronics, clothing and machinery. A large segment of these are manufactured in China due to economies of scale and the depreciated Chinese Yuan vis-à-vis US dollar. These production facilities have taken away US jobs. The US President made promises during his election campaign to bring back these jobs. However, US consumers have also benefitted from these low prices.

In order to correct the trade balance, President Trump initiated a trade war with China and imposed tariffs amounting to US $ 250 billion on Chinese imports in 2018. The Chinese have also imposed tariffs on imports of US $ 110 billion on US imports. The US has further threatened punitive tariffs on an additional US $ 267 billion imports (Koty, 2019). The tariffs on China represent a fundamental retreat by the US from the global trading system. In the past the US supported free trade and upheld this position on various occasions.

Now the question arises – how will this trade war affect not only these two countries but the world? According to the International Trade Centre, the US and Chinese global exports account for around one-fourth of the world exports.

Even before the current steps taken by US government to correct the trade imbalance, China had been deemed as a threat by different US companies on the pretext of stealing intellectual property, deliberately devaluing Yuan to leverage partial advantage in exports, dumping its product in the international market at low prices due to the availability of cheap labour, etc. The increase in international trade has increased the interdependence of countries. The trade war between China and the US is, therefore, impacting the world. As per the theory of international trade – cooperation and rule-based systems lead to global welfare, while a competitive approach is likely to generate sub-optimal results. A trust deficit between trading nations escalates into protectionism and thus into economic isolationism. This has been aggravated by American apprehension of being dominated by China as a global economic super power – due to its remarkable progress over the last four decades. These fears may be unfounded because still there is a huge gap between the GDP per capita in nominal and Purchasing Power Parity of the two countries as indicated in Table No. 1.

Table #1: GDP of US and China

| Country | GDP per Capita $ | Rank | GDP/ Capita $(PPP) | Rank |

| US | 61,687 | 8 | 61,687 | 13 |

| China | 9,377 | 74 | 17,943 | 78 |

(Source: IMF World Economic Outlook, October 2017)

Additionally, it is pertinent to mention here that the accelerated growth of China was always considered as a threat by numerous US governments over the decades. All sorts of allegations have been levelled against China, ranging from undervaluing currency to dumping to stealing technology to violating human rights, etc. It is also interesting that 60% of Chinese exports to USA are from US MNE’s that established their operations in China to benefit from various supporting cost cutting elements. Accordingly, it is likely that these US companies may become victims of this trade war and may resist any such move(s). A core factor that has widened the trust deficit is US’s allegations on China on cybercrimes and violation of intellectual property. The USTR has stated that the US has lost between US$225 billion and US$ 600 billion annually due to these violations (Pham, 2018).

FDI in China

Prior to 1980, the only commercial relation between China and the outside world was through foreign trade. Direct Foreign Investment was not permitted in China. In 1978-9, Deng Xiaoping introduced market liberalizing reforms and ‘opening-up’ policies, which revolved around a economic revitalization program referred to ‘Four modernizations’. Its goal was to improve agriculture, industry, defense and science & technology. The program required foreign capital. At that time Foreign Direct Investment (FDI) to china was practically nil. To attract foreign capital and technology, China allowed joint ventures in 1979. Within the next two decades China became the biggest recipient of FDI in the developing world. Some inherent factors helped China in attracting FDI, which include: (a) market size (b) an abundant skilled and semi-skilled labour availability (c) Infrastructure (d) the role of the Chinese diaspora as a source of foreign capital and expertise.

During 1978-84 China attracted Foreign Direct Investment to the tune of $ 360 million per annum. As market reforms took root, FDI shot up; for instance, during 1984-88 FDI exceeded $ 2 billion per annum. In 1990, it had reached $28 billion – 4.4 % of China’s GDP and nearly double the FDI flowing to developing countries. During the Asian financial crisis in the 1990s there was a slight decrease in FDI. Nonetheless, during 1995-99 China received a staggering $41 billion per annum – 4.7% of China’s GDP. Data for 1997 is particularly impressive considering the financial crisis that hit the fast-growing emerging market economies of Asia with full force. Yet, in that year $ 46.3 billion poured into China. In terms of the sources of FDI, major contributors have been the European Union, USA, Japan, Taiwan, Singapore and South Korea. In 1999, EU accounted for 11% of FDI, the USA 10% and Japan 7%. During 1995-2003, US FDI in China increased by 6% annually, which was mainly concentrated in manufacturing (67% according to a study by the US Bureau of Economic Analysis in 2001). Within this segment, electronics and other electrical equipment’s accounted for 35% and industrial machinery and equipment accounted for 17%. In contrast, 90% of US FDI in Hong Kong was in finance, real estate and insurance (Analysis, 2002). This partly reflects the desire of US investors to leverage the benefits available in China, which, in turn, helped China to integrate itself with global supply and production chains. Thus, in the last decade – even though the rate of US-originated FDI for China’s manufacturing sector levelled-off – the overall volume of FDI in manufacturing exceeded investment in other sectors. Other sectors that attracted FDI from USA were real estate (24%) followed by transport, wholesale, and retailing. According to a study of Zhang (2006) and others, the significant growth in China’s foreign trade in the past two decades is strongly linked to the inflow of FDI (Dodovskiy, 2012). This was further substantiated by the OECD report (2000) that FDI has been a decisive factor in China’s involvement in the international segmentation of the production process known as globalization (Dodovskiy, 2012).

Despite the fact that wholly owned subsidiaries are allowed in China, more than 85% of US companies opted for joint ventures. More than 70% investment was made in the 1980s by US firms in China and their mean investment was around 30%. These joint ventures helped US firms to minimize their business risks by developing partnerships. In a nutshell, low cost of labour and local partner knowledge of china’s environment coupled with capital, technology and management skills from US firms created synergies and benefited both sides.

China as a hub of production networks

Chinese economic rise is one of the most spectacular developments in the post World War II era – eclipsing the fabulous rise of Germany and Japan. Total goods exports from China increased from $8 billion (1% of global exports) in 1978 – when China initiated its liberalization process – to $ 408 billion (7.7% of global exports) in 2000 and to $ 2.5 trillion (19% of global exports) in 2018 (ITC, 2019). In 2004 China overtook Japan to become the third largest exporter in the world after USA and Germany, and, three years later, it became the second largest exporter. Since 2009, China has been the largest exporting nation. China’s ratio of exports to GDP currently stands at 32%; compared with an average level of 10% for other major economies such as USA, India, Brazil (Statista, 2018).

China’s extraordinary export growth has been strengthened by a shift in the commodity composition of its exports – away from primary products and towards manufactured products. The share of manufactures in China’s total merchandize exports shot up from less than 40% in the late 1970’s to more than 90% over the next two decades – while the global average was 70%. Domestic production networks in China have successful integrated to achieve economies of scale during this period. Till 1990, China’s focus was on labour intensive industries such as textiles, footwear, leather toys, and sports goods, while, since then, China has moved towards broader categories such as machinery and transport equipment. China has been making rapid progress in the production and supply of machinery, which shifted towards ICT and high-tech products during the last decade. For this shift in the export’s composition, MNE’s played a substantial role. The share of MNE subsidiaries manufacturing exports from China increased from 10% in early 1990 to 60% in 2010 (Lardy, 2014).

The underlying factors behind China’s rise as a premier production center was its cheap labour, trade liberalization, infrastructure development and ease of doing business in the shape of ZEZ’s. In terms of labour supply, China had the advantage of having an abundance of supervisory, midlevel and unskilled cheap workforce. This was termed as the major reason of relocating manufacturing facility to China by Steve Jobs during the visit of President Barack Obama to Apple’s assembly facility in China in 2001 (Isaacson, 2011). Moreover, China acceded to the World Trade Organization in 2001, which also set a favorable ground for business operations. There are possibly four Labour-related reasons behind the increase in manufacturing exports in China. Firstly, even though average domestic wage has increased significantly in China over the last three decades, China’s manufacturing wages are still lower vis-à-vis USA and other industrialized countries.

Table#2, Labour Wages in China

| Country | 2010 | 2014 |

| Australia | 71,420 | 84,743 |

| Canada | 53,454 | 58,452 |

| France | 72,771 | 74,403 |

| Germany | 75,519 | 78,895 |

| UK | 61,958 | 70,400 |

| USA | 77,055 | 87,021 |

| China | 15,508 | 16,287 |

(Source: US BEA, 2014)

Secondly, there are vast pools of cheap labour still available in interior provinces of the country. This gives them the option to relocate their manufacturing to these areas to counter rising wages in the coastal areas. In order to develop these areas and increase their connectivity to the outside world, China is building the China Pakistan Economic Corridor (CPEC). Thirdly, the increase in labour costs has largely been offset by a reduction in the cost of services through trade and investment policy reforms, and, more importantly, improvement in the provision of trade related infrastructure. Lastly, China has the advantage of being able to meet labour requirements for large scale assembly operations within the global production network.

Production sharing between China and USA

Major exports of China to USA comprise of manufactured products (95%) which have largely been achieved due to the relocation of production centers by international (specially US companies) to China. Initially, these companies were importing raw material from USA and using China only for production of finished products to capitalize on cheap and trainable labour. This trend slowed over the years, as these companies have started to find suppliers of raw materials within China and the region. These changing trade patterns are reflected in the bilateral trade data. Manufactured products account for almost all of China’s trade surplus with the US as their imports by the US has increased five folds (from about US$ 50 billion to more than $ 300 billion from 2000 to 2015). This is contrary to popular perception in USA regarding massive consumer product procurements by Walmart or other US retail stores. Over the past decade more than 85% products traded between the two countries have been manufactured products. Most of the US MNE’s are vertically integrated in global industries. They have shifted the final assembly processes to China while retaining mostly product design, global marketing and other headquarter functions in the US. In this context a relevant fact is the importance of these US MNE’s in exports to other countries. In 2013, the amount of goods exported to the rest of the world by US affiliates in China was $ 37.5 billion, which was almost three times the value of their exports to USA ($ 13.6 billion).

Table#3, Exports and local sales of US companies based in China

| Good and services | Goods | |

| Total sales | 261.8 | 217.7 |

| Local Sales | 206.7 | 166.6 |

| Exports | ||

| To the USA | 15.4 | 13.6 |

| To other countries | 39.7 | 37.5 |

(Source: US BEA 2016)

What influenced US companies to invest in China?

According to the latest investment trends monitor published by the United Nations Conference on Trade and Development (UNCTAD), China has emerged as the largest recipient of FDI ($ 70 billion) in 2018 followed by UK ($ 66 billion) and USA ($ 46 billion). The winning strategies of China include economic liberalization, a focus on high technology and an array of comparative advantages offered by cheap and trainable labour. This has been supplemented by massive development in transportation, communication and Information Technology during the last three decades. China also transformed its command and control model of economy to a market driven economy which assisted in integrating China with the global economy and helped attract technology and FDI. US Companies like Apple and Tesla are heavily investing in China and are also engaged in technology transfers.

Leading US Companies affected by trade war

Some US companies like Nike, Apple, Starbucks and Tesla have substantial footprints on Chinese soil and are reaping the benefits. Nike is now doing better in China than its traditional markets like Latin America. Apple has more than $ 9 billion annual sales in China despite tough competition from local Chinese technology companies 8. Starbucks opened one and a half new stores per day in China during 2016 and sales growth in China and the Asia Pacific region increased by 110% year over-year to $652 million, compared to 11.3 percent growth of $3.38 billion in the Americas (Ahya, 2019). China is home to more than 3,000 Starbucks cafes, nearly 8 percent of the company’s worldwide total. Tesla is already feeling the heat of these tariffs as it has major stakes in the Chinese market. Tesla plunged as much as 6.3% to $224.50, the lowest intra day since January 2017, after China defied U.S. President Donald Trump by announcing plans to raise duties on $60 billion worth of American imports starting from 1 June, 2019 (Dey, 2019).

Similarly, USA is also the preferred destination for Chinese students and expatriates. Leading Chinese technology companies like Huawei are using semi-conductors of Apple. After these sanctions, Google has forced Huawei to use an open-source version of Android (CNBC, 2019).

Relocation of Industries of Pakistan

Many primary sources were contacted. They greatly helped in understanding the dynamics of these complex relations and how this would affect the future of both countries and the region. In order to complete this task many interviews were held with people associated with CPEC. These interviews were mostly unstructured. Open-ended questions were asked so that the interviewees could express their views openly and as per their liking. Two experts dealing with the subject who need a special mention in this regard are: Mr. Badar u Zaman, Commercial Counsellor, Embassy of Pakistan, Beijing and Mr. Hassan Daud Butt, Project Director, CPEC, Planning Commission, Islamabad. Mr. Badar u Zaman helped me in understanding the history, dynamics and coverage of the corridor. He also connected me to many Chinese exporters, businessmen and Pakistani entrepreneurs dealing with Chinese Companies. It may also be added here that I also visited China four times during June-December 2018 in an official capacity and had a chance to interact with more than 200 Chinese companies. Since the announcement of OBOR, there is considerable interest by Chinese companies to go global. As per some studies, the preferred destinations of these companies are Vietnam, Singapore, Malaysia and Japan 9. Pakistan, although not in the list, cannot be sidelined because of its multiple strategic advantages. Many Chinese companies, understanding the comparative advantage, have started their operations in Pakistan in chemicals, textiles, steel and aluminium (USA has imposed 25% duty on the imports of steel and aluminium from China and China is the largest exporter of iron and steel to USA). Chinese Businessmen, like Mr. Wu Zhidan from Hiebird Steel, are facing closure of their plants in China and are actively working to relocate their steel plants to Pakistan 11. The Chinese government is also offering subsidies and preferred loans for these relocations. Likewise, I interviewed Mr Wang, who is a US based supplier of aluminium. Mr Wang is also facing closure of his factories in China and has already relocated his project to Thatha District and has stated exporting to USA. His products are subjected at 0% duty in the US, while if the origin of the same products was China, then he would be subjected to 25% duty. In case of textile, Challenge apparel has already started production in the suburbs of Lahore. They are also considering another plant in Karachi, to avoid inland freights, as most of their products are exported to European Union and USA.

These personal interviews with dozens of Chinese companies and visiting their plants in China and Pakistan has broadened my vision regarding CPEC. I am confident that CPEC will bring prosperity to Pakistan.

Conclusion

This study concludes that there is a huge trade imbalance between the US and China which has resulted in escalating tensions between the two. These tensions will keep surfacing in the future due to the nature of the economic and political relations between the two countries. Efforts by world leaders to take measures to correct trade imbalances lead to economic nationalism and protectionist policies. These policies may prove counterproductive in the long run and can have a negative impact on the multilateral trading system and decrease global economic welfare.

It took decades of negotiations after World War II to reduce tariffs and establish GATT in 1947. It took another fifty years to create the WTO regime in 1995. These efforts can be jeopardized if nations start taking protectionist and nationalist trade measures. Thus, international organizations and world leaders need to collaborate through bilateral and multilateral discussions to amend trade tensions and guard against threats to the multilateral trading structure of the world.

If this trade war between these two economic giants continues and becomes more intense then its effects would not be restricted to just the US and China. Currently, US consumers are being made to pay higher prices for ‘made in America’ products instead of cheap Chinese products. Likewise, US companies would have to find other destinations to relocate their production center 13. This will also affect Chinese manufacturers and government as it may potentially decrease the inflow of FDI coupled with a negative effect in the acquisition of technology, especially in Artificial Intelligence14. A major discord of President Trump is regarding the poor record of China in connection with intellectual property rights protection, which includes requiring foreign companies to transfer their technology as a precondition to investing in China (Yueh, 2018). Trade tensions between the US and China could trigger a shift towards a non-cooperative game in international trade whereby self-interested actions turn out to be sub-optimal for individuals and the world community (Ahya, 2019). International organizations – World Bank, WTO, IMF, etc. – need to take a more proactive stance to alleviate concerns between the two countries and resolve the conflict before it spirals out of control.

Policy recommendations

The above discussion substantiates that growing trade difference between the US and China is a structural phenomenon, exacerbated by global production and value chain which both economies benefit from. Protectionist policies would hurt manufacturing and may lead to job losses in both countries and also other countries associated with this supply chain in any context. Keeping in view this complicated nature of interdependence, the US government’s imposition of tariffs on China is bound to face formidable resistance from major business interests in USA, especially the one’s based/connected with China. So far this venture to bring ‘factories home’ has not materialized beyond the much trumpeted case of Ford Motors and Carrier Corp. These two have announced to abandon their plans to setup production plants in Mexico. It has been observed by some that US firms are already back to their usual practice of ‘going global’ after a pause in the immediate aftermath of President Trump’s election victory.

However, the world economic order remains embroiled in confusion. There have been some statements appearing in the media that suggest that companies are also considering relocating to other countries like India, Vietnam, Pakistan if these tariffs continue, rather than returning to the US. It may be added here that the US government has also recently announced to strip exemptions granted to Indian textiles, leather, jewellery, auto parts and agriculture products from 5th June, 2019 (Goel, 2019), which indicates that the US would be pursuing protectionist policies in the future, as well.

There’s a need by the Chinese side to open up their economy and also start respecting the IPR as alleged by various countries. Though the Chinese government has taken a degree of measures during the last two decades to improve their record. Likewise, aggressive trade policies containing hidden subsidies are also likely to affect the international reputation of China as a business leader. On the other hand, the US President also needs some prudent advice to pursue open market policies and to avoid disrupting the free flow of international trade.

USA is the largest export destination of Pakistan, while China is the largest trading partner of Pakistan. USA has been a strategic ally of Pakistan. Both countries have had a ‘boom and bust’ relationship. With China, Pakistan has enjoyed friendly political and strategic relations, which are now translating to economic relations with the start of the China Pakistan Economic Corridor (CPEC) and, since the past five years, China has been the largest source of inbound FDI. With this background, Pakistan is likely to get affected by this trade war more than any other country. The challenges and ramifications for Pakistan are however still shrouded in mystery and uncertainty. The best outcome for Pakistan would be normalization of relations between the two world powers, which will also be good for global political and economic order.

Despite problematic issues pertaining to global trade – such as environment, economic displacements, generation of a skewed distribution of gains from trade, etc. – it still helps in creating global prosperity. As Paul Krugman puts forth, the global powers opting for protectionism have to bear the cost of inefficiency as imposition of tariffs prevents productive specializations (Krugman, 2018). Moreover, trade protectionism hampers complex global value chains. In manufacturing, the upstream process in the supply chain suffers due to production bottlenecks caused by escalated tariffs while the downstream phase loses the opportunity and benefits of upgradation. In a nutshell, the loss incurred by all the stakeholders in the global supply chain will not augur well for global prosperity. Through massive improvement in infrastructure, ICT, communication and transportation the world is becoming more interlinked and, as a consequence, even a small disruption at times has unfathomable ramifications.

On the flip side, there may be some countries that can take advantage of the current scenario. This trade war, for instance, affords an opportunity to Pakistan in terms of the relocation of Chinese industries to Pakistan. But this opportunity is also available to many other countries and different analysts and experts are attempting studies to forecast these relocations, which likely depend upon the receptive or welcoming socio-political and economic environment of the host countries. There is some consensus that Vietnam is likely to benefit the most from this relocation, considering its ability to absorb FDI vis-àvis its offerings. The Government of Pakistan should also make the necessary arrangements in its legal and administrative setups, rules and procedures to take advantage of this opportunity.

Bibliography

Ahya, C., 2019. CNBC. [Online] Available at: https://www.cnbc.com/2019/05/20/morgan-stanley-more-tariffs-on-china-could-trigger-a-global-recession.html [Accessed 22 May 2019] .

Analysis, B. o. E., 2002. Survey of Current Business, Washington : Government of United State.

Andriole, S., 2018. Forbes. [Online] Available at: https://www.forbes.com/sites/steveandriole/2018/11/09/artificial-intelligence-china-andthe-us-how-the-us-is-losing-the-technology-war/#315df2961957 [Accessed 20 March 2019].

Anon., n.d. Arunachalam, S. a., 2018. The US- China Trade Competition- An Overview. Municpal Personal RePEc Archive, 9 June, pp. 1-14.

Beinart, P., 2019. The Atlantic. [Online] Available at: https://www.theatlantic.com/ideas/archive/2019/04/us-trade-hawks-exaggerate-chinas-threat/587536/ [Accessed 30 May 2019].

C.F, B., 2006. China: The Balance Sheet , New York : Public Affairs Publishing .

CNBC, 2019. CNBC. [Online] Available at: https://www.cnbc.com/2019/05/19/google-suspends-some-business-with-huawei-after-trump-blacklist.Html [Accessed 30 May 2019].

Dey, E., 2019. Fortune. [Online] Available at: http://fortune.com/2019/05/13/teslastock-china-auto-tariffs/ [Accessed 22 May 2019].

Dodovskiy, J., 2012. Research Methodology. [Online] Available at: https://researchmethodology.net/the-impact-of-foreign-direct-investment-fdi-on-chinasinternational-trade/ [Accessed 10 April 2019].

Doorn, P. V., 2018. Market Watch. [Online] Available at: https://www.marketwatch.com/story/trade-war-watch-these-are-the-us-companies-with-the-most-at-stakein-china-2018-03-29 [Accessed 4 25 2018].

Feenstra, R. C., 2010. Offshoring the Global Economy. 1 ed. Cambridge : The MIT Publishers .

Goel, A. S. a. V., 2019. The New York Times. [Online] Available at: https://www.nytimes.com/2019/05/31/business/trump-india-trade.html [Accessed 31 May 2019].

Isaacson, W., 2011. Steve Jobs, New York: Simon & Schuster.

ITC, 2019. Trade Map. [Online] Available at: https://www.trademap.org/Index.aspx [Accessed 20 April 2019].

Koty, D. W. a. A. C., 2019. China Briefing. [Online] Available at: https://www.china-briefing.com/news/the-us-china-trade-war-a-timeline/ [Accessed 12 April 2019].

Koty, D. W. a. A. C., 2019. China Briefing. [Online] Available at: https://www.china-briefing.com/news/the-us-china-trade-war-a-timeline/ [Accessed 31 May 2019].

Krugman, P., 2018. Trade Wars, Stranded Assets, and the Stock Market (Wonkish). [Online] Available at: https://www.nytimes.com/2018/04/04/opinion/tradewars-stranded-assets-and-the-stock-market-wonkish.html [Accessed 20 April 2019].

Lardy, N. R., 2014. Markets Over Mao: The Rise of Private Business in China. 1 ed.

Washington DC : Peterson Institute of International Economics.

Morrision, W. M., 2019. US china Trade Issues, Washington: In Focus .

Pham, S., 2018. CNN Business. [Online] Available at: https://money.cnn.com/2018/03/23/technology/china-us-trump-tariffs-ip-theft/index.html [Accessed 22 April 2019].

Schuman, M., 2016. Is China Stealing Jobs? It May Be Losing Them, Instead. Beijing : The NewYork Times .

Statista, 2018. The statistical Portal. [Online] Available at: https://www.statista.com/statistics/256591/share-of-chinas-exports-in-gross-domestic-product/ [Accessed 15 April 2018].

Yueh, L., 2018. How a US-China trade war would hurt us all. [Online] Available at: https://www.theguardian.com/commentisfree/2018/apr/05/us-china-trade-warsupply-chains-consumers [Accessed 14 April 2019].

Yusuf, L. A. W. a. S., 2007. Dancing with Giants, China India and the Global Economy, Washington : IBRD, World Bank.

Zander, B. K. a. U., 2003. Knowledge of the firm and the evolutionary theory of the multinational corporation. Journal of International Business Studies , pp. 495497.

References

1- During the 1980s, the exports of the Japanese cars to USA complete the local car manufacturers to reduce their profits and lay off workers. Despite pressure from local car companies, USA did not impose punitive tariffs on car imports, rather opted to resolve this issue by trade negotiations.

2- The classical economists like Adam Smith and David Ricardo praised free trade based on comparative advantage and maintained that each country would benefit if it specialized in the production and export of those goods that it can produce at relatively low cost

3- Stephen S Roach, Michael Pettis, Dr. Steinbock

4- An organization of Brazil, Russian, India, China and South Africa

5- Local Chinese have been critical of preferential treatment available to alien companies, but Chinese government maintained that they would have to dance with to wolves, if they wanted to survive.

6- Jing Wang, President, Vig-Pak Recycling, USA

7- Shafiq A Shahzad Joint Secretary and others

8- China generates 25% of all Apple’s profits and is the company’s second-largest market. Over time it is expected to eventually become the company’s single biggest market

9- Business Insider, 28 August, 2018

10

11- Mr Badar u Zaman, Commercial Counsellor, Embassy of Pakistan, China

12

13- According to Mukesh Aghi, president and CEO of the Washington-based U.S.India Strategic Partnership Forum, roughly 200 U.S. companies has approached their organization and are considering relocating to India. A large number of such firms especially in steel and aluminum sector are also considering Pakistan as a destination as well according to Mr. Wang Zhenyue, President, Shenglin steel, Liaoning, China.

14- According to the Mizuho Research Institute in Japan, Vietnam is Asia’s biggest beneficiary from the U.S.–China trade war, with foreign direct investment in Vietnam reaching $19.1 billion in 2018, 9.1 percent higher than the value in 2017.