Abstract

(This is the second part of a two-part paper which highlights some recommendations to stabilize and bring Pakistan’s economy back on track, creating an essential base for a more sustainable future, especially for Pakistan`s teeming millions who are currently on a knife’s edge due to an eye-watering cost of living crisis. Ideas formulated in this report can be used as a foundation to form a broader dialogue involving the government, civil society, policy experts, IMF, key donors, the private sector and other stakeholders – Author)

This report highlights the economic challenges faced by Pakistan and recommends actionable initiatives to bolster the country`s economy, currently on life support.

The proposals can form a “solid base” from which the country can fiscally course correct, catapult and grow. Pakistan`s economic malaise might be inevitable but is certainly not inescapable.

The recommendations in this paper need to be part of a much broader national dialogue and roadmap spearheaded by financiers, economists and policy practitioners seeking to rectify Pakistan`s manifold financial ills.

Robust coordination among policymakers, public authorities, donors and lenders is paramount. All key stakeholders must be brought to one platform to develop a future roadmap with consensus for ramping up the economy, in order to address the challenges facing Pakistan, now and in the future.

To stabilize the economy and align policy implementation with the IMF-supported program, donors, the private sector and other key stakeholders this paper recommends actionable urgent priority areas that need to be further addressed, bringing Pakistan`s economy back on track and creating an essential “economic base” for a more sustainable future.

In order to come out of the current economic abyss, Pakistan must undertake the recommendations highlighted hereunder (many of which have already been underscored by the donor agencies, economists and policymakers alike).

Unwavering Implementation of the 2023 Budget

Pakistan’s 2023 budget is far from perfect. However, we must remember that the current coalition government presented its first budget on June 10, 2022. While drafting the budget, the government encountered manifold economic challenges ignited by an increase in fuel prices, tenuous delays in IMF negotiations for budgetary support, a free fall of an ever-weakening rupee and an alarming rise in the cost of living.

A resolute and unfaltering implementation of the FY2023 budget is necessary as per IMF requirements. The budget aspires to reduce the government’s huge borrowing needs by targeting an underlying primary surplus of 0.4 percent of GDP, underpinned by current spending restraint and wide-ranging revenue mobilization initiatives targeted towards higher income taxpayers. Development spending must be protected in future budgets and more financial leeway created to further widen essential social support schemes. For the FY2023 budget the provinces have agreed to support the federal government’s efforts to attain fiscal targets, and Memoranda of Understanding have been inked by provincial stakeholders to this effect1.

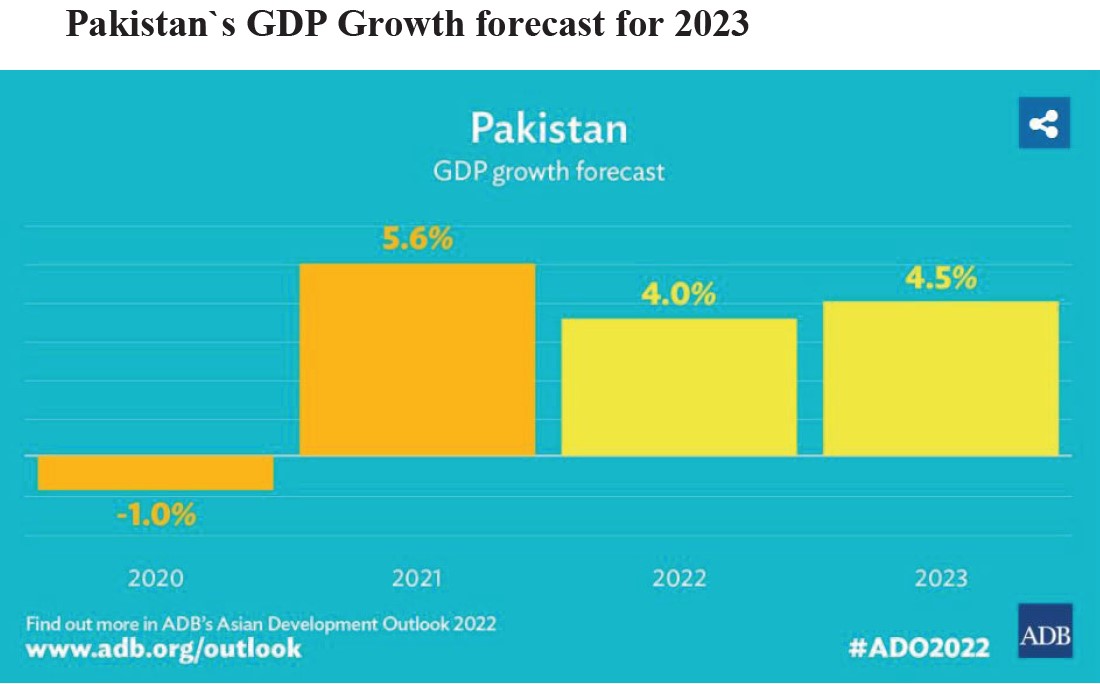

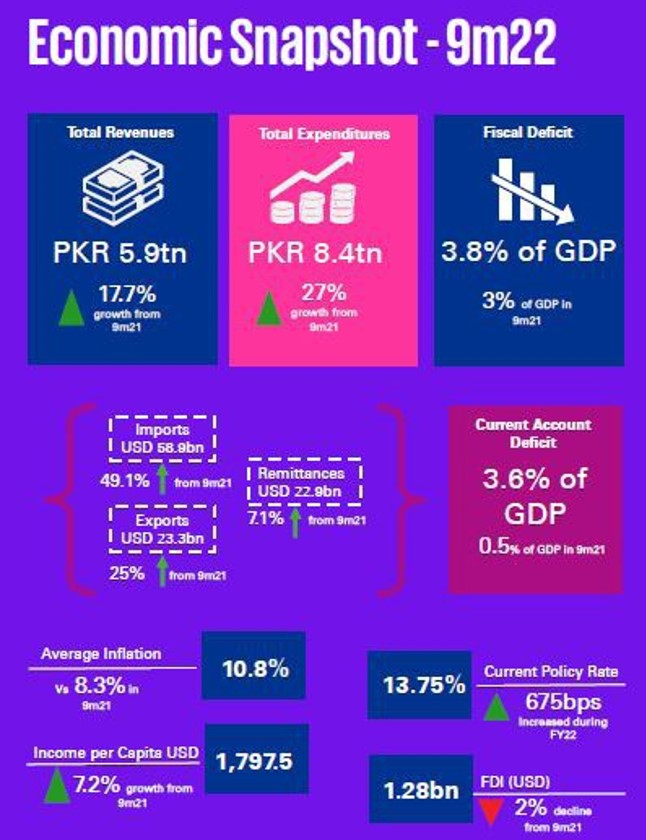

Growth indicators exhibited by the Economic Survey of Pakistan (Ministry of Finance) do show hope for (moderate) optimism with a more balanced outlook. The GDP growth rate for FY 2021-22 is positively forecasted at 5.97% versus 3.94% for the previous year. Revenue therefore increased by 17.7%2.

Source: Asian Development Bank, 6 April, 2022.3

Source: Asian Development Bank, 6 April, 2022.3

“Pakistan’s economic recovery after the COVID-19 crisis indicates that the country has enormous potential to overcome challenging economic situations,” said Najy Benhassine, World Bank Country Director for Pakistan. “However, sustaining the economic recovery requires addressing long-standing structural weaknesses of the economy and boosting private sector investment, exports and productivity.”4

On the back of high base affects and recent monetary tightening, real GDP growth is expected to moderate to 4.3 and 4.0 percent in FY22 and FY23, respectively. Thereafter, economic growth is projected to slightly recover to 4.2 percent in FY24, provided that structural reforms to support fiscal sustainability and macroeconomic stability are implemented rapidly, and that global inflationary pressures dissipate5.

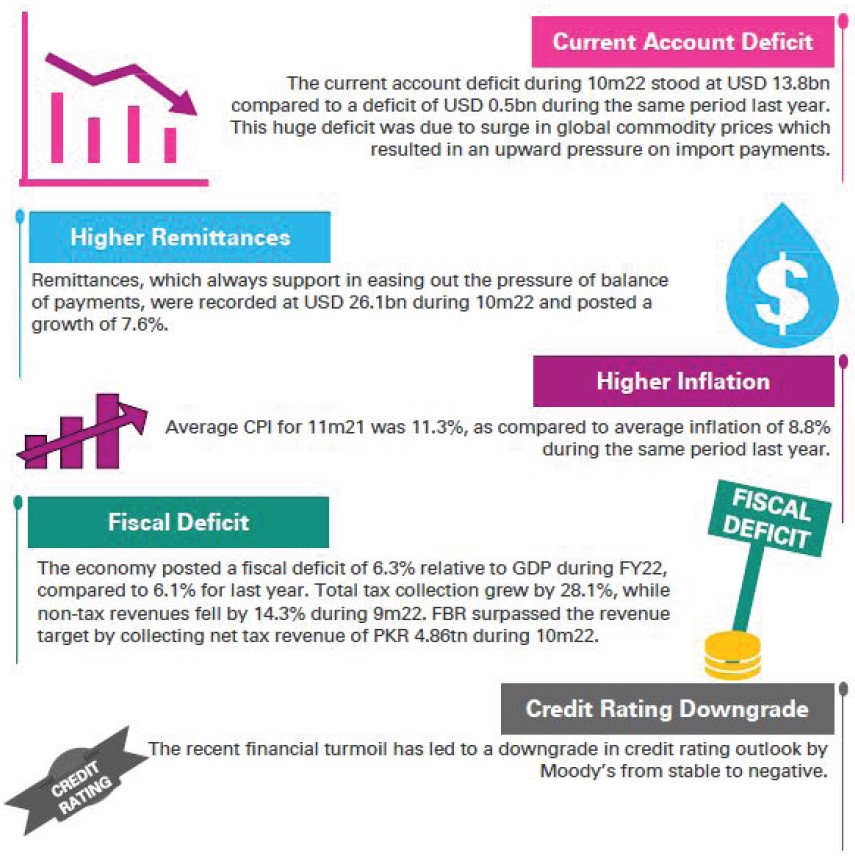

The current account deficit unhealthily peaked at USD 13.2 bn which was not contained in spite of a 7% rise in expatriate/diaspora’ remittances. The current account deficit was spawned by an increase in imports. In the first nine months of the FY 2021-22 (July-Mar), the goods import increased by 26.6% to USD 23.7 bn, and the trade deficit alarmingly grew to 55.5% or USD 30.1bn, as the current account deficit is now at a staggering USD 13.2bn. The Current account balance during Jul-Apr, for 2020-21 had been in surplus of USD 0.8 bn6.

Source: KPMG Taseer Hadi & Company, Economic Brief, KPMG, June, 2022.7

The most exorbitant problem is the rising burden of debt servicing on the fragile economy. Annually, around 70% of the total Federal Government’s resources are consumed by debt servicing whereas the permissible limit is 60% of the GDP as set by the Fiscal Responsibility and Debt Limitation (FRDL) Act, 20058. The total debt servicing for the next year will be PKR 3,950 bn. Another PKR 2,632 bn (USD 23.5 billion) will be required to repay the debt due in 2023. Worse still, Pakistan will alarmingly have to repay on account of amortization and mark-up amount owed by the public sector alone to the tune of USD 49.23 billion over the next five years period from 2022-23 to 2026-279.

Boosting Exports

Pakistan`s exports must be made more competitive, it`s exporters must leverage Artificial Intelligence and Big Data to harness the potential of online marketing platforms. Export routes and destinations need to diversify. Businesses should be facilitated to comply with international standards under a one shop window operation. The Board of Investment, Trade Development Authority of Pakistan, State Bank of Pakistan and Ministry of Commerce should develop an interoperable online platform to facilitate exporters in all these respects and more.

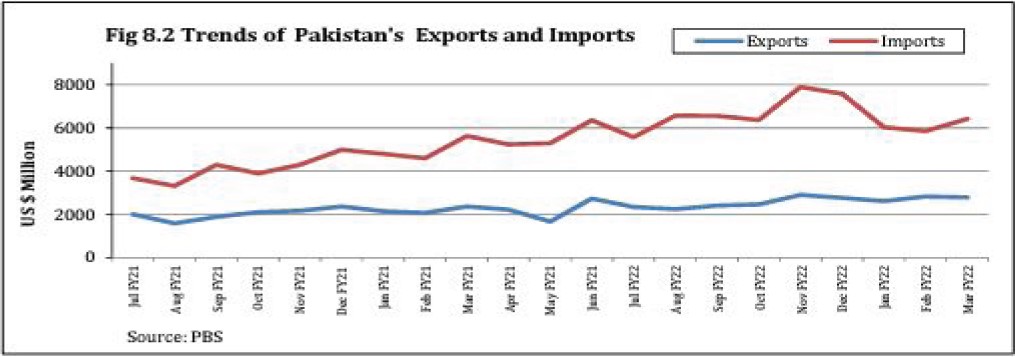

Owing to pro-business initiatives and recent rupee depreciation, exports underwent an impressive rise of 25% during Jul-Mar FY2022 amounting to USD 23.3 billion as compared to USD 18.7 billion in the same period last year10. A significant amount of this uptrend emanated from the high value-added segment of the textile sector, whereby Pakistan’s textile exporters benefited from the SBP’s concessionary refinance schemes for working capital and fixed investment, and regionally competitive energy tariffs.

11

11

Pakistan`s imports have been reduced considerably by policy measures to USD 4.9b in July 2022, down from USD 7.7b in June 2022.

There will also be tax incentives for companies exporting at least 10 per cent of their production. This is a positive initiative, though to achieve this, businesses require a guaranteed supply of utilities and facilitated payment modalities. Furthermore, the export-based margin of profit needs to be seriously higher than what the companies get in the domestic market. Will the government keep its end of the deal? Will the corporate sector be willing to put in the hard miles and indulge in the kind of creative rethinking that is required?12

Importantly, to enhance monetary policy transmission, the rates of the State Bank of Pakistan’s (SBP hereafter) two major refinancing schemes—Export Finance Scheme (EFS)13 and Long Term Financing Facility (LTFF)14—will continue to be linked to the interest policy rate. SBP also tied the interest rates of the EFS and LTFF to the monetary interest policy rate and gave a 500-basis point discount relative to the policy rate to enhance exports. This measure has (partially) worked as Pakistan’s trade deficit decreased by 18% YoY and 47% MoM during the month of July 2022, mostly owing to a decrease in import costs.15

Various policy measures were taken to support industrial activity and increase exports. Some of these initiatives are:

- Supply of energy to export oriented sectors, including textile, at regionally competitive rates i.e., electricity at US cents 9/kWh all-inclusive and RLNG at USD 6.5/MMBtu all-inclusive during FY 2022.16

- Release of Rs 16 billion under Duty Drawback of Taxes and Levies (textiles & non-textile) till the third quarter of FY2022.

- Continuation of duty-free import of textile machinery to encourage investment in the textile sector and enhance capacities.

- Coverage and loan limits under Long Term Financing Facility (LTFF) were enhanced. The SBP opened up LTFF for all sectors17. To encourage new projects, the SBP doubled the maximum loan size for a single project to Rs 5 billion from Rs 2.5 billion. Subsequently, the SBP reduced the mark-up rate on LTFF for non- textile firms to 5 percent, aligning with the rates charged to textile firms.

- Incentives were introduced for exporters to bring FX proceeds in a timely manner. In February 2022, the SBP allowed Rupee-based discounting of export bills for exporters availing the Export Finance Scheme (EFS) and Islamic Export Refinance Scheme (IERS), at very attractive rates. The initiative encourages timely arrival of FX proceeds into the interbank market, and also facilitates exporters to retain access to concessionary working capital.18

- Changes made in FX regulations to facilitate exports. The SBP introduced a range of changes to FX regulations, to simplify export procedures and encourage diversification in the country’s exports of goods and services. To facilitate exporters, particularly SMEs, to sell to customers worldwide via digital/online platforms (including Amazon, eBay, etc), the SBP introduced a new framework for exports under business-to-business-to-consumer (B2B2C) mechanism. The SBP also updated regulations to facilitate exports of information and communications technology (ICT), including from freelancers, and to help start-ups attract foreign investment and boost digital entrepreneurialism19.

- To facilitate micro small and medium businesses, an e-Taijarat portal was developed and launched on 21 February 2022. The portal will provide freelancers educational opportunities and marketplace opportunities to help them grow and flourish as business owners20.

- Export Facilitation Scheme, 2021 Federal Board of Revenue has notified rules for new Export Facilitation Scheme (EFS) 2021 which is effective since 14th August 2021 This Scheme runs parallel with existing schemes like Manufacturing Bond, Duty and Tax Remission for Exports (DTRE hereafter) and Export Oriented Schemes till August, 2023.

- Users of the aforementioned schemes include Exporters (Manufacturers cum Exporters, Commercial Exporters, Indirect Exporters), Common Export Houses, Vendors and International Toll Manufacturers. Users of this Scheme are subject to authorization of inputs by the Collector of Customs and Director General Input Output Organization (IOCO).

- Process simplification and automation under WeBOC21 and Pakistan Single Window (PSW hereafter) where users of the Scheme and regulators (IOCO, Regulator Collector, PCA, etc.) are integrated through WeBOC and PSW and communicate through these systems. The focus of the Scheme is on post clearance compliance checks and audits.

The FBR’s Export Facilitation Scheme (EFS 2021) reduces cost of doing business and cost of tax compliance, improves ease of doing business, reduces liquidity problems of exporters by eliminating Sales Tax refunds and Duty Drawback for the users of the Scheme and should attract more users and ultimately promote exports22.

Moving Towards Self-Sustenance and External and Development Independence.

No nation can prosper in isolation. Trade is essential. Pakistan seeks to import much but has limited competitive goods to export in return. It, therefore, perpetually borrows from global lenders or is reliant on aid to plug the gap. This is where donor agencies and multilateral lending agencies such as the World Bank, the IMF and the Asian Development Bank, come in. They provide grants or loans on cheaper terms than commercial sources, but always with “strings attached”. The seminal question remains: are institutions like the IMF and World Bank a cure or a curse? Over the short-term they are certainly “a cure”.

A September 2018 piece for the Guardian, by broadcaster Kenan Malik, described foreign aid as a “fraud” perpetuated by rich countries to bribe or blackmail weaker economies. He asserted that multilateral funding, by institutions such as the IMF, is determined by the interests of powerful countries23. There is reason to agree.

In FY 2021, Pakistan paid back USD 600 million more to the IMF than it received from it, while in FY20 Pakistan received a net USD 2.1 billion. In total, the net of all multilateral and bilateral funds received in July-March of FY22 was only about USD 5bn. For a country with an ‘official’ GDP of USD 380bn, these amounts seem tiny. Some political economists query that it would seem quite a mystery as to why Pakistan`s successive governments have remained very compliant and deferential to rich countries rather than focusing on getting their own house in order first.

The retort to such political economists is because on the one hand, the country’s expenditures (and imports) far exceed its revenues (and exports) as exhibited below.

Source: Pakistan Economic Survey (2022) Finance Division, June, 2022.24

Furthermore, in Pakistan, while a few donor agencies usually work through the government (Japan’s JICA is pure government to government), most donors initiate and sponsor projects themselves (with funds routed through the Economic Affairs Division and more). International NGOs bring in their own funds or implement their donors’ projects.

Therefore, at any given time, hundreds of projects/local stakeholders can be involved in a plethora of diverse sectors under the guidance of such foreign agencies and INGOs. This implies that there has not been a fully integrated development strategy or programme for the country over the last few decades. Such perpetual outsourcing of the country’s priorities and development stratagem and implementation runs contrary to any recognised concept of management, self-sufficiency, and leadership.

Once projects culminate, experienced and highly trained project staff are let go. There is a domino effect on government capacity building, as its regular staff misses out on that valuable experience and training in programme design, documentation and implementation oversight. Institutional learning and memory are lost.

In addition, Pakistan has to tread carefully in its path towards self- sustainability because of the fear of sanctions (Pakistan has already been grey-listed by the FATF and it is not wise to go the North Korea route). The country’s exports, its overseas workers and acquisition of defence equipment are all highly sensitive to sanctions. Our overseas workers are (largely) unskilled, and relatively easily replaced from other poor states. A little Middle Eastern kingdom in a bad mood can do us much harm.

The above partially explains why Pakistan avoided cost competitive gas and electricity from Iran and now cheap oil from Russia since our scanty exports are also easily replaceable.

Pakistan’s major export destinations are 21% to the US, 11% to China, 7% to the UK, 5% to Germany and so on. It is dependent on being granted a ‘favoured’ status by Western countries to export there. An annoyed West can easily get towels and textiles from elsewhere and also refuse visas to eager officials with multiple future aspirations.

In the past, there were occasions when delivery of military equipment for which payment had already been made was delayed over a perceived slight25. The Pressler Ammendment, denying Pakistan military assistance springs to mind.

A mature, self-sustaining country with a robust economic base does not require global agencies to strong-arm it towards prudent financial and monetary management. To be truly sovereign and self-sufficient, Pakistan must balance its expenditures with its revenues (boost exports). The country must make itself resilient to external pressure. The more trained and skilled our overseas workers are, the higher paid and less easily replaced they will be. Given Pakistan`s highly educated youth bulge and demographic dividend the Skills Development Council (SDC) and the National Vocational & Technical Training Commission can play an instrumental role in producing and vocationally training a highly skilled and specialized workforce for the 21st century.

Export destinations and export goods must not only be diversified but export contracts should be won on merit, in open and fair competition, not by relying on receiving “favoured nation” status26 as is presently the case.

Indigenization and self-reliance in producing defence equipment must be the aspiration. This will be possible with a defence strategy that is appropriate for a less developed country, which is necessarily divergent from the strategies of the great powers, where many of our military officials receive their training. Defence expenditures27 can also be financed by manufacturing and exporting military equipment (as Pakistan currently does to Western African and certain Middle Eastern countries).

Power and Energy Sector Reform and Diversification

An unprecedented energy debacle grips Pakistan. A supply crunch and an increase in energy prices place unfair pressure on the economy, hurting Pakistan’s people.

For the sake of Pakistan’s long-term self-sustaining “economic base” development and the economic security of the country’s over 220 million citizens, policymakers must be cognizant that only a proactive approach to the current energy crisis is the way forward.

The power and energy sectors of Pakistan are in a shambles, a black hole devouring and destroying the economy. The government incurs high levels of debt from private power generating enterprises while being unable to meet increasing energy demands of a rising population. Energy and power sector reform and diversification must therefore form part and parcel of Pakistan’s “economic base” towards self-sufficiency for the future.

Fuel and raw material imports for electricity production amount to an exorbitant USD 12 billion and weigh immensely on the national exchequer. The situation has worsened with the rupee devaluation which, in turn, has hiked electricity prices that has been passed onto consumers. The viable way forward is to pull to pieces this shambolic and inefficient system and incrementally migrate towards renewable and eco-friendly means of producing energy, especially given Pakistan’s climate vulnerability as witnessed during the August 2022 flash floods.

The power sector circular debt (CD) flow is expected to grow significantly to about Rs 850 billion in FY22, whereby the Power Division held the National Electric Regulatory Authority (NEPRA hereafter) responsible for adding Rs 500 billion to the circular debt flow due to a delay in notifications for the rebasing of Rs 7.91 per unit and Quarterly Tariff Adjustment (QTA) determination28, jeopardizing the power sector’s viability, and leading to power outages and load shedding.

Given the global energy supply constraints and price hikes sparked by the Russia Ukraine war, Pakistan is advised to diversify her energy portfolio. One such migration can be towards solar, especially since Pakistan has the potential of producing 2.9 million MW of solar energy.

The incumbent government has realized this as they expect to launch solar projects of 9,000 MW on a priority basis29 to reduce the burden on the power sector. Under this, solar systems will not only be given at discounted prices, but incentives will be furnished in terms of tax. In order to make this more sustainable over the long-haul, the government can go a step further by introducing residential solar units and loaning them off to consumers. This will help citizens pay off the loan with ease through an installment plan, besides allowing the government to generate revenue for reinvestment.

Pakistan must reap the merits of the thousands of qualified electrical engineers it produces and encourage experimentation from the university level. This will indigenously build local infrastructure and enhance the power sector at the grassroots level. Resorting to fossil fuels is less of a viable option as the Ukraine war attests, especially for a densely populated country reeling from the effects of climate change.30

The Ministry of Energy (Petroleum division) sought exemption from mandatory Third-Party Access (TPA hereafter) to new LNG terminals, since the gap between gas supply and demand in the nation has deepened leading to acute gas shortages affecting economic activities.

There is a paramount need to diversify the LNG import infrastructure and motivate foreign and private investment in new LNG import terminal facilities (at their own costs and risks) to meet the surging demand of RLNG in Pakistan. In lieu of this requirement the ECC excluded new LNG terminals and related facilities from TPA application by amending Article 6.2(a) of the 2011 LNG policy.31 Engro Elengy Terminal Pakistan (EETL) is the first LNG32 import facility in Port Qasim.

Qatar supplying LNG on deferred payment plans is a blessing in disguise for an energy-and-cash starved country. Pakistan has two long-term LNG supply deals with Qatar with nine cargo shipments per month.

Other energy sector reforms: There are other innovative ways of enhancing energy and power sector efficiency – notably smart urban planning. Cities are the primary consumers of energy and are, thus, poised to play a meaningful role in lowering energy demand. Empirical evidence suggests that relevant and smart urban planning and transport policies can reduce energy consumption in cities by 25% by 205033. This calls for compact urban forms and transport planning for cities in developing countries.

Time is long overdue for policymakers to prioritize sustainable urban planning, specifically development of compact urban forms. While this may not be a cure-all panacea for Pakistan’s energy crisis, its potential and promise to mitigate forthcoming crises (climate induced or otherwise) cannot be taken for granted.

A compact urban structure can adopt several initiatives, many of which centre around achieving transport energy savings by encouraging public transportation usage thereby lowering the requirement for private vehicles use. A ‘concentrated decentralization model’34 highlights a shift away from monocentric to polycentric structures connected by transport corridors. While a monocentric urban structure involves concentration of a majority of the activity around a single urban pole, a polycentric design involves an urban form comprising of several sub-centres incorporating all the necessary facilities and amenities35.

Such smart sustainable cities36 urban design models advocate integrating transport and land-use planning, providing efficient public transport systems, prioritizing dense settlements, and creating mixed-use spatial units, including neighborhoods incorporating multi-dimensional facilities such as commercial, residential and recreational.

On an encouraging note, development of mixed-use and gated communities37 is on a rise in Pakistan. Many new high-rise apartment projects have emerged, which accommodate greater population densities, especially in major metropolises such as Karachi, Lahore, Islamabad and Rawalpindi.

Robust interaction among architects, environmentalists, policymakers, public authorities, and local decision-makers responsible for urban and transport planning, along with empowerment of the local authorities, and partnerships with research institutes and universities can help achieve the objectives of developing urban forms which are conducive to reducing energy consumption.

The aspiration of sustainable compact urban development coupled with creative ideas must be cultivated in Pakistan if we are to harness the potential of urban planning in guaranteeing long-term energy reform and management.

Broadening the Tax Base

The FBR Tax revenue target for 2022-23 is PKR 7,470 bn, a 21.5 % increase from the PKR 6,148.5 bn collection for 2021-2238.

“The (former) finance minister claimed during the budget speech about PKR 3000 bn leakage of the funds implies that the tax revenue target should have been increased by at least PKR 3000 bn, especially as he claims to curb the “leakage”. The indirect tax to direct tax ratio has remained constant for the Revised Targets of 2021-22 and the Target for 2022-23. This ratio for both the years is 1.7. That signifies that no tax reform to increase the horizontal base for direct tax is expected in 2022-2023. This also nullifies the Finance Minister’s claim that they are protecting the poor and taxing the rich.”39

Despite what the former finance minister had claimed, this increase in the FBR revenue collection target for FY 2022-23 by PKR 1,322 billion is a formidable task considering the state of the economy and the priority of the government to control inflation and the current account deficit which would concomitantly reduce imports and slowdown economic growth.40

In an article published in the Business Recorder, Sohail Sarfaraz wrote: “To achieve the target several efforts are being made at the policy as well as operational levels. There is a focus on enhanced use of technology and a policy shift towards taxing the high-income groups through direct taxation such as the imposition of super tax, poverty alleviation tax, revision of individual tax slabs including salaried class, increase in the federal excise duty (FED) on international air travel, increased tax on luxury motor vehicles etc.”

Broadening the tax base is important as it ignites a sense of civic duty and engagement in a citizenry and “ownership” in social stakes and outcomes. The importance is that any tax regime should be progressive as opposed to regressive and those with the broadest financial shoulders should bear a higher burden. However, tax increase without improved social services is counter-productive and keeping tax brackets unrealistically high only encourages evasion. So, taxes must be simplified, rationalized, fair and consistent across the board.

Consistent and Continued CPEC Execution – Phase 2

The former PTI government established a CPEC Authority to hasten implementation of its second phase. Although the government did not empower the Authority with decision-making powers, the latter nonetheless significantly assisted in removing hurdles and smoothen execution of CPEC projects.

The current PML-N government decided to scrap the Authority. The government asserts it “could not deliver as special economic zones (SEZs) are not fully operational”. The government has now embarked on reverting to an approach which it incorporated during Phase 1. Here again Pakistan is the victim of policy inconsistency due to changing governments.

The government has the right to render verdict over the future of the CPEC Authority. Yet, prior to undertaking hasty decisions there was a judicious requirement to delve into the reasons and impediments in the smooth execution of Phase 2. In that pursuit, Pakistan must introspect. The first question to be answered is whether the second phase is similar or different from the first phase. The answer is CPEC’s phase two is a very different kettle of fish. The first phase was led by government- government or government-business cooperation.

During Phase 1 the Government of Pakistan was taking a lead to implement. There were hardly any hassles in acquiring licenses or registration or the execution of the projects. However, Phase 2 is all about Business-to-Business (B2B) and private sector-led cooperation. The business community will have to take care of everything from registration to execution of plans and handling tax authorities. Unfortunately, the business environment of Pakistan is not that conducive, enabling and empowering as yet. The issues are complicated institutional framework, with complex and lengthy procedures and corruption.

Though the Ease of Doing Business (EODB)41 ranking of Pakistan has improved, many problems are still haunting the country. For instance, it takes 113 days to get an electricity connection, 125 days for construction permits and 105 days for property registration, by book. In reality, it takes many more days42. Pakistan has to improve its World Bank Ease of Doing Business Index if it wants to lure foreign investment.

Ease of Doing Business in Pakistan 2012-2020

43

The 18th Amendment44 has further complicated the institutional framework. The tax system is another challenge for which investors and industry must bear the brunt. There are an overwhelming 35 departments or agencies which are involved in the taxation system, including highly arcane provincial tax regimes. All this requires streamlining.

Lack of harmonisation of tax policies of provinces is one of the biggest bottlenecks to attract foreign direct investment. Inconsistency is another problem in taxation policy which is impacting the trust of business community.

Another question that arises is why are the SEZs not fully operational (CPEC has existed since years) and attracting investment from countries other than China. CPEC, a USD 46 billion dollar project, has been operational since 2015 and has had 7 full years to operationalize SEZs but neglected to do so.

The analysis of the situation suggests a lack of the right set of policies and ignorance of global best practices are the leading factors behind this below average performance. Pakistan had envisaged to set up approximately 27 SEZs, out of which nine were prioritized, across the country as part of its infrastructure development.

Empirical research on SEZs suggests there are five key pillars which play a pivotal role in deciding their future. First, the location of SEZs plays a significant role. Economists believe that economic rationale should dictate the selection of the location. Unfortunately, in Pakistan political proclivities dictate such decisions. Second, innovative policies assist any SEZ gain traction. Third, policies should be designed to attract investment and industry, not to please selective elitist audiences.

Fourth, sound marketing policies and strategies45 based on facts and data are required to attract investors. Pakistan does not have such a marketing policy or strategy for SEZs. Such initiatives (including online digital marketing and platforms) must feature more prominently in the long-term plan for the CPEC 2030 policy.

Islamabad cannot attract investors by offering grandiose statements, it must offer business-friendly rational choices conducive to investment. For example, to date, we have not conducted any comparative analysis of Pakistani SEZs with global SEZs to figure out the former’s comparative advantages46.

Pakistan is blessed with multiple universities and countless worthy research institutions and think tanks. The Planning Commission dedicates research centres for CPEC and PIDE, but no study is available that can help convince investors. The only available study on the subject is a commentary on the SEZs of different countries, not a comparative analysis of policies, rules, procedures or incentives highlighting Pakistan`s competitive advantage.

A few months back Pakistan organised a special meeting for ASEAN countries to invite them to join CPEC. One wonders how we can ask ASEAN countries to join CPEC in the presence of the Regional Comprehensive Economic Partnership (RCEP)47. To persuade ASEAN members to join CPEC we need a resilient rationale which can surely be provided by a comprehensive SEZ comparative analysis.

Fifth, effective and efficient management of SEZs plays a pivotal role in deciding the fate of any SEZ. The level of effectiveness and efficiency in designing, execution and facilitation plays a leading role in attracting foreign direct investment. Foreign investors look for minimum hassles, less bureaucracy, one stop platforms and they do not like to run after multiple institutions or agencies. They prefer to invest in SEZs which are immune to political interference, and shielded from complicated institutional frameworks, complex procedures and corrupt practices.

Our contemporary institutional arrangement does not allow any ministry or institution to play a decisive role in CPEC`s Phase 2. Rather, it has given birth to internecine tussles among and within ministries and regulators. There is need of a strong central CPEC body which can help contain festering tugs-of-war and grease the wheels for smooth implementation of CPEC’s Second Phase.

The Authority must be a watchdog and must possess decision- making and implementation powers immune from interference from any ministry or institution. The body should be only answerable to the Prime Minister. Lastly, if PMLN does not like the CPEC Authority, it can come up with a better idea or name, but what is required is seamless and smooth execution and implementation.

Regional Geo-Economic Connectivity and Trade

To enhance its “economic base” it is high time for Pakistan to intensify regional geo-economics and further integrate with trade corridors such as the Iran, Turkey Pakistan railway initiative, the Greater Eurasian Partnership (GEP), the Belt and Road Initiative (BRI), amongst many others. The SCO summit can allow Pakistan to augment trade ties with regional partners in prosperity. Such trade talks should go beyond Track II diplomatic talks and delve deeper into intense economic opportunity.

Regional geo-economic connectivity in South and Central Asia is taking longer than anticipated due to a lack of sophisticated infrastructure, project lags, and instability in a teetering Afghanistan one year after the Taliban assumed power. Full stability in Afghanistan would tremendously catalyze Pakistan’s gains as a strategic gateway between South and Central Asia and further beyond.

In July, Tashkent convened two main international conferences with deep ramifications for South Asia. The first was an international conference where almost 30 nations engaged with the Taliban on Afghanistan. The second meeting in Uzbekistan was a foreign minister’s gathering under the auspices of the Shanghai Cooperation Organization (SCO)—a multilateral coalition that aspires to enhance stability throughout Eurasia—where the main agenda was regional safety, stability and measures to curb alarming inflation. The SCO summit was hosted by the SCO Foreign Ministers Council and was attended by Pakistan’s Foreign Minister, Bilawal Bhutto.

Such summits highlight how Central Asia has emerged like a phoenix from the proverbial ashes as a pivotal focus for South Asian strategic foreign policy alignment. Central Asia increasingly shapes South Asian geopolitics and geo-economics. This has reverberations for South Asia from a few perspectives.

Over the past few years, Ashgabat and Tashkent hosted summits on Afghanistan with Taliban delegations, focusing on wide-ranging topics from security to connectivity to power lines. The interests of the Central Asian Republics align with those of South Asia, especially regarding stability in Afghanistan and regional connectivity and their membership status overlaps in several regional alliances such as the SCO (which added Islamabad and Delhi in 2017), the Economic Cooperation Organization (ECO) and the Organisation of Islamic Cooperation (OIC) and the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline, now being revitalized by India. Without Islamabad and Delhi one cannot architect a comprehensive system of stability in Eurasia.

Central Asian and South Asian states jointly participated in Turkey’s Heart of Asia Istanbul Process with a focus on Afghanistan. Russia’s Greater Eurasian Partnership might offer future South and Central Asian states further strategic foreign policy alignment.

Central Asian Republics have monumental geographical gravitas for South Asian states. Three Central Asian states border Afghanistan. The Afghanistan-Uzbekistan Friendship Bridge in Hairatan, Afghanistan testifies to increased rapprochement.

Islamabad is especially interested in Central Asia due to the region’s lucrative oil and gas deposits. India and Pakistan have insufficient local gas supplies and seek to diversify their energy portfolio beyond a highly volatile Middle East and Russia.

Pakistan is focused on “geo-economics” with Central Asia, including initiatives to boost energy and trade agreements. Examples are the Agreement between Uzbekistan and Pakistan on Transit Trade (AUPTT) operationalized in March 2022 and the bilateral Preferential Trade Agreement (PTA) where Pakistan aspires to tap into a potential USD 90 billion which offers Central Asian states access to Pakistan’s strategic seaports, notably Gwadar, making Uzbekistan less reliant on the Iranian seaport Bandar Abbas via Turkmenistan. Other initiatives include the Pakistan-Uzbekistan Joint Ministerial Commission, the Pakistan-Uzbekistan “Silk Route Reconnect” Business Forum, the ECO Free Trade Agreement (ECOTA) and the UN supported Afghanistan Pakistan Transit Trade Agreement (APTTA) evidenced by the opening of the bilateral Wagah trade border48.

In June-July 2022 humanitarian aid to Tajikistan was offered to overcome the devastation wrought by floods (especially in Pamir, Rasht valley, Khatlon and Khorog) and chilling winters. Pakistan can send or invite a delegation and learn valuable lessons as it too suffered a similar fate owing to the flash floods.

Pakistan and India each distinctly implement separate projects bolstering rapprochement with Central Asia. India aspires to assist by developing the port of Chabahar in south Iran to boost trade through Afghanistan. Pakistan hopes to collaborate with Kabul and Tashkent on the new Trans-Afghan railway linking Uzbekistan to the ports of Pakistan. Afghanistan and Uzbekistan have drawn a roadmap for it’s realization.

Central Asian Republics have their own motives to enhance integration with Delhi and Islamabad as they seek broader access to each country’s warm-water ports for trade and commerce, quenching Central Asia’s thirst for strategic water routes and trade. Pakistan`s Gwadar port links to China’s Western Kashgar, Xinjiang bordering Kazakhstan, Kyrgyzstan and Tajikistan.

Pakistan enjoys a strategic vantage point over India, as the most direct land routes to Central Asia course through Pakistani soil cementing it`s role as a transit trade hub. Pakistan usually does not offer India transit trade rights. Undismayed and resolute, Delhi has enhancesd its presence in Afghanistan, by partially reopening it`s embassy in Kabul to boost access to Central Asia.

Changing foreign policy imperatives in South Asia augment Central Asia’s growing diplomatic and trade outreach, notably in Afghanistan. As opposed to commonly held assumptions, Beijing, Moscow and Tehran espoused a vigilant approach and restricted their presence in Afghanistan since America’s departure in 2021. The geopolitics of South Asia can no longer solely be analyzed through the prism of India- Sino rivalry or the Great Power Contest between China and America.

In the coming years Pakistan and India will increasingly compete for soft power in Central Asia with a dependable and durable foothold serving their national interests where some stakeholders could exploit disorder. This simultaneously opens up broad possibilities and rivalries in trade, security, counter-terrorism and cultural interchanges.

Path-breaking Innovation: Pakistan Pioneers Towards a Blue Economy

If the August 2022 flash floods proved one thing it is that Pakistan must swiftly transition towards economically sustainable sectors such as an often under-reported “blue economy”. Since everyone already speaks about transitioning towards a well-known “green economy” this analyst wants to draw the audience’s attention to an eco-friendly newly emerging “blue economy”.

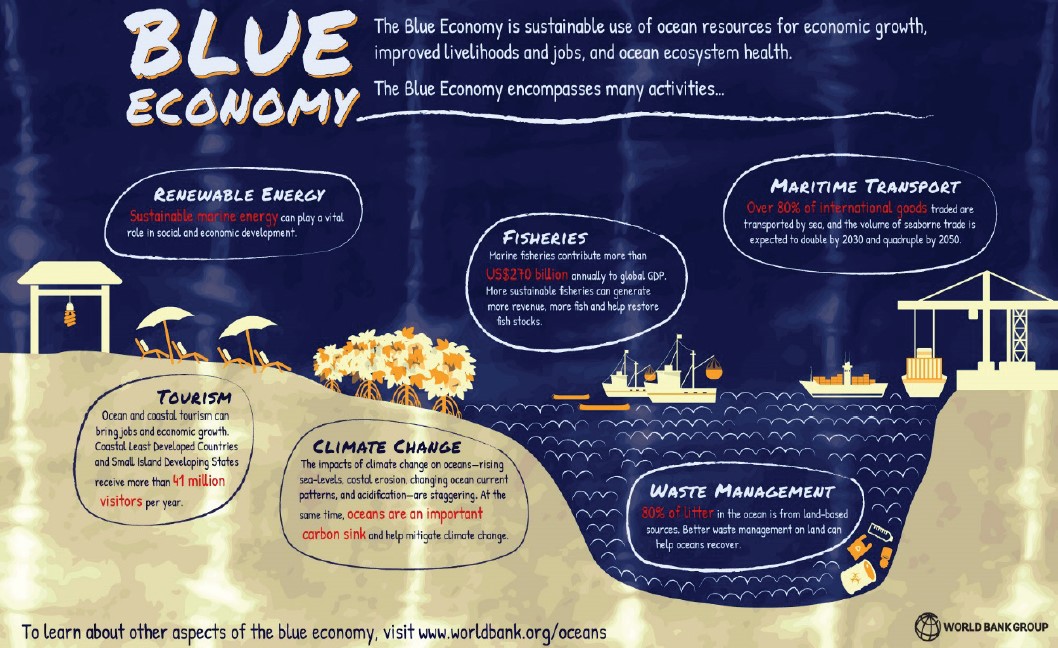

The “blue economy” has increasingly gained traction and involves protecting the earth’s oceans and responsibly utilizing (increasingly scarce) water resources for sustainable development. The concept at its core refers to promote usage of ocean49 resources and marine islands for economic advancement, social inclusion, poverty mitigation and the protection of livelihoods while safeguarding the ecological sustainability of the oceans and coastal50 areas. It includes numerous activities related to renewable alternative energies, waste management, fisheries, maritime transport, coastal eco-tourism, and climate change risk mitigation/reduction.

Source: The World Bank (2017) What is the blue economy, June 6, 2017.

In addition, numerous innovative specialization sectors such as ocean engineering, marine chemistry, oceanography and biomedicine have been given birth to in a “blue economy” which promises ample employment prospects and wealth generation for any coastal state. Global economists attribute an astronomical asset value of USD 24 trillion to the ocean economy. At present it is generating between USD 400-500 billion per annum in terms of the “dividend to humanity”. One essential trial which the Blue Economy51 must surmount is to better understand, resource allocate and sustain numerous facets of oceanic sustainability, from fisheries to biodiversity to marine protection to ecosystem health to pollution.

Pakistan’s coast is about 990 Km long, stretching from the Indian border in the east to the Iranian border in the west, enriched with fisheries, minerals, and hydrocarbon resources.

Pakistan is a geo-strategic maritime state nestled along the increasingly vital Indian Ocean Region (IOR) and is at the tip of the iceberg in terms of exploiting the benefits of a bustling Blue Economy. Pakistan enjoys a thousand kilometer long coastline and the Exclusive Economic Zone (EEZ) covering an estimated 240,000 square kilometers. Further, an allowance of continental shelf worth fifty thousand square kilometers was permitted by the United Nations Commission on the Limits of the Continental Shelf (UNCLCS) in 2015. Pakistan’s current maritime revenue forecast is an estimated USD 182 million lagging behind India and Bangladesh, whose appraised forecasts52 are at USD 5.6 and USD 6 Billion respectively.

Special Climate Assistant, Mr. Aslam, articulated that Pakistan launched its first blue carbon estimation, assisted by the World Bank which approximated that with the nation’s present and forthcoming tree plantation projects — including planting 10 billion trees over the next couple of years — if conducted successfully would be worth USD 500 million by the year 2050.

Pakistan’s coastal areas are extremely resourceful in bio-productivity and biodiversity, furnishing significant swathes of breeding terrain for financially lucrative fisheries, most notably carbs and shrimps, with a potential net worth exceeding USD 2 billion per annum. Despite a gargantuan fishing export potential, Pakistan’s fishing industry sector contributes a meagre 0.4% percent to the nation’s GDP though, in 2020 the industry saw a growth of 0.6%. This demonstrates how little we are growing despite having tremendous potential in this domain which in turn hinders our growth potential over the long-haul53.

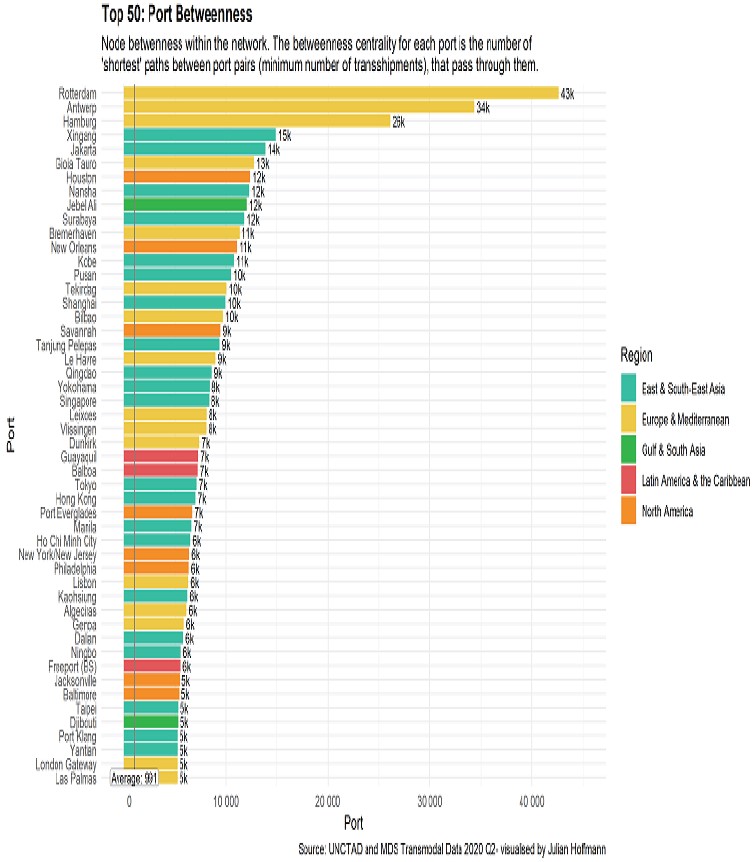

CPEC is a flagship project, a harbinger for Sino-Pak rapprochement54. The epicenter of this bilateral friendship geo-strategically gravitates towards the Gwadar Port. Due to its strategic positioning, this port is transforming into the epicenter of the Belt and Road Initiative (BRI). The Gwadar port can play a pivotal role in revolutionizing Pakistan’s market through trans- shipment by itself. Shipping remains the most cost-competitive means of transport. Today eighty percent of global merchandise in trade volume is transported via sea, which totals to 10 billion tons.

Pakistan enjoys a high Liner Shipping Connectivity Index (LSCI). The LSCI embodies how resilient the connectivity is between ships and ports worldwide. Pakistan is located at exactly 34.06 points in the LSCI, which gives it an unassailable advantage in terms of global container shipping network connectivity. Pakistan fares better than Bangladesh, but lags behind India whose LSCI is at 54. China leads the pack with an enviable index of 151.91.

Source: UNCTAD (2020) Top 50 Port “Betweenness”, MDS Transnational Data, report from the second financial quarter of 2020.

Source: UNCTAD (2020) Top 50 Port “Betweenness”, MDS Transnational Data, report from the second financial quarter of 2020.

Pakistan can reap rich dividends by seamlessly integrating it’s global container connectivity network, enhance its trans-shipment industry and deepening trade ties. Given the monumental distance ships have to currently travel to reach Gulf based GCC states via detours from the Indian Ocean; Gwadar has the opportunity to transform into a fully developed regional commercial hub and a transshipment port (just as Dubai is at present) in the near future.

Strategically diverting maritime/container traffic from Dubai towards Gwadar could render it into one of the top-five transshipment hubs of the world. UAE handles over twenty-one million TEUs (ton equivalent units) per annum. This illustrates the lifelong opportunity that Gwadar represents. Being a tax exempt duty-free port (like Dubai’s Jebel Ali at present) along with no port congestion, implies that Gwadar can arbitrage such advantages for promising returns.

The projects underway, such as the Gwadar East-Bay Expressway, constructing the breakwaters, dredging docking terminals, the development of Free Trade Zones, Gwadar International Airport and Gwadar Smart Port City55 if managed responsibly, will significantly add to Pakistan`s blue economy by institutionalizing closer trade connectivity routes (reducing carbon footprint aligning with climate objectives) and attracting oceanic eco-tourist passengers. Inter-connecting Gwadar Port and the Free Zones with a growing network of highways guarantees a smooth supply chain and a seamless logistical transport hub for imports and exports thereby expanding the net worth and resourcefulness of CPEC.

The shipbreaking sector of Pakistan, notably Gadani, bustled in the 1970s. If this sector is brought back to life and used to its full potential, it can also contribute in enhancing our GDP per annum.

Though, Pakistan National Shipping Corporation at present transports 99% import of gasoline products it holds a tiny number of cargo vessels that solely carry 7% of cargo worldwide, while the remaining 93% is transported by global/foreign corporations which produce foreign exchange of USD 1.5 billion per year. Such economic statistics can crucially help Pakistan overcome the economic malaise plaguing it and reignite the spark of a country’s economic fortunes56. To optimally benefit from the nation’s maritime industry, there is an urgent requirement for a seamlessly integrated National Maritime Policy to meritoriously capitalize from our ocean’s infinite dividends.

Ecological coastal tourism can also attract millions of tourists to Pakistan from around the globe. The country’s sea coasts are blessed with breath-taking biodiversity and attractive beaches and can be a magnet for global travelers. Currently coastal tourism only amounts to USD 0.3 billion despite it`s realistic USD 4 billion potential.

Another indictment for Pakistan is our ranking on the “Travel and Tourism Competitiveness Report” measured by the World Economic Forum, which ranks Pakistan at an abysmal 121st position out of 140 states. Pakistan remains woefully lacking in “competitive” indices throughout South Asia in travel and tourism57.

In 2020, despite the raging Covid-19, there was a 0.7% surge in citizens visiting Dubai, taking the figure to sixteen million as per the recent statistics published by the Emirate’s tourism body. Another report titled “Cultural Heritage and Museum visits in Pakistan” published by the Gallup survey underlines how visitor numbers grew from 1.6 million visits in 2014 to 6.6 million visits in 2019, a 317 per cent increase in visits to cultural sites, illustrating a yearning to travel and soak in culture and nature, largely attributable to rising disposable income.

The visually stunning coastal attractions of Pakistan, if sustainably developed, will witness soaring coastal and eco-tourism as citizens are yearning for recreation activities in a post-lockdown post-Covid 19 world which kept them geographically chained.

All this illustrates the trajectory we as a nation need to undertake, bridging the gap for Pakistan’s prescient blue economy which must be harnessed to kick-start the economy.

It is high time to frame a rigorous national climate compliance mechanism and synergize the institutional efforts to tap the “Green” and “Blue” economic revolutions which can blaze a trail for Pakistan. Moreover, CPEC and sustainability are not mutually exclusive. CPEC positioned plans to augment ocean-based activities is required to exploit invaluable maritime opportunities.

Pakistan must enhance its economy while simultaneously focusing on maritime infrastructure development, technology access for offshore resource deployment, maintaining a resilient fisheries and marine leisure sector and boosting ecological coastal tourism. There exist genuinely bona fide reasons for Pakistan to endorse and institutionalize the promise of a Blue Economy in policy, bilateral transactions, multilateral diplomacy and international relations.

A Path Forward

In a post IMF bailout Pakistan, in order to turn things around, Pakistan must get its priorities straight. There needs to be more focus on policy and less on politics. This needs qualified, mature, thoughtful, and dispassionate individuals at the helm rather than radical ideologues and rapacious political rabble-rousers.

Changing a nation’s outlook and psyche takes decades; if we do not start making necessary changes now the situation will deteriorate drastically.

Can the situation get any worse? It surely can. When a country travels on a downward spiral, there is no such thing as rock bottom. The rabbit hole58 never ends. Actionable recommendations in this paper can help ensure Pakistan sees better days as an uncertain future unravels.

A closer evaluation of the root-causes that triggered Pakistan’s economic freefall must be undertaken in detail by Islamabad in order to forecast and avert a similar dramatic downturn in the future. As the flame of hope extinguishes in Pakistan, concrete action plans are required by decision-makers for the worthy citizens of Pakistan to alleviate their socio-economic trials and tribulations.

If substantive, cautious and earnest policies are initiated with time sensitivity, the state of affairs can be reversed.

References

- Porter, Nathan (2022) IMF Reaches Staff-Level Agreement on the Combined Seventh and Eight Reviews for Pakistan’s Extended Fund Facility, The International Monetary Fund, 13 July, 2022.

- Khan, Raza, Qasim (2022) FBR Directorate General of Revenue Analysis, Evidence based revenue forecasting 2022-2023, Federal Board of Revenue, 2022.

- Pakistan’s GDP growth forecast for 2023 (2022) Asian Development Bank, 6 April, 2022.

- Benhassine, Najy (2022) World Bank Country Director Pakistan, April 19, 2022.

- Long-standing structural challenges pose risks to Pakistan`s sustained growth (2022) World Bank Bi-Annual Pakistan Development Update Report, April 19, 2022.

- Pakistan Economic Survey (2021-22) Chapter 8 Trade and Payments, Finance Ministry, 2022.

- KPMG Taseer Hadi & Company (2022) Economic Brief, KPMG, June, 2022.

- For legal analysis on this legislation review: Jin, Yang Hyun (2010) Pakistan: Monitoring Implementation of the Fiscal Responsibility and Debt Limitation Law, International Monetary Fund’s Public Financial Management Blog, March 22, 2010.

- Pakistan to repay $23bn foreign debt in next fiscal year (2022) The News International, 4 June, 2022.

- Trends of Pakistan’s Exports and Imports (2022) Pakistan Bureau of Statistics, 2022.

- Trends of Pakistan’s Exports and Imports (2022) Pakistan Bureau of Statistics, 2022.

- Hussain, Mazhar (2022) Increasing exports, Dawn, Karachi, 30 August, 2022.

- EFS is a transaction based facility. Banks having EFS limits provide export finance to the exporters at pre-shipment and/or post-shipment stage on case to case basis against Export Letter of Credit/Contract for export of eligible goods.

- Under the State Bank`s LTFF, Participating Financial Institutions (PFIs) provide long term local currency finance on concessional rate of 6% as compared to normal KIBOR (which is higher) for purchase of plant and machinery to be used by the export oriented projects meeting specified LTFF offers long term local currency finance for imported and locally manufactured new plant and machinery to be used by the export oriented projects issued by Ministry of Commerce. For more review: State Bank of Pakistan (2018) SBP’s Instructions on Long Term Financing Facility (LTFF) (https://www.sbp.org.pk/MFD/2018/Instructions-LTFF.pdf )

- SBP to present monetary policy today (2022) Daily Times, August 22, 2022.

- Ghumman, Mushtaq (2022) Export-oriented sectors: Govt has agreed to supply energy without disparity, Business Recorder, July 25, 2022.

- As per Export Policy Order (2020) by the Ministry of Commerce (MOC hereafter), January 2020.

- State Bank of Pakistan (2022) IH & SMEFD Circular, Number 3 of 2022, February 16, 2022

- State Bank of Pakistan (2020) Foreign Exchange Circular Number 7 of 2020, December 2, 2020.

- Youth should in no way miss IT revolution to generate revenue, fill trade gap (2022) Associated Press of Pakistan, 21 February, 2022

- Web Based One Customs (WeBOC) System of Goods Declaration and Clearance. WeBOC is Pakistan`s indigenously developed, web-based computerized clearance system, providing end to end automated customs clearance of import and export goods.

- Federal Board of Revenue (2021) Export Facilitation Scheme, 2021.

- Malik, Kenan (2018) As a system, foreign aid is a fraud and does nothing for inequality, Guardian, 2 September, 2018.

- Pakistan Economic Survey (2022) Finance Division, June, 2022.

- Ahmed, Zafar (2022) The reality of foreign assistance, Dawn, 3 September, 2022.

- Ahmed, Zafar (2022) The reality of foreign assistance, Dawn, 3 September 2022.

- Khan, Bilal (2019) Understanding Pakistan’s defence industry woes, Quwa, August 13, 2019.

- Ghumman, Mushtaq (2022) Rs 500 billion addition to circular debt: Power division holds Nepra responsible, Business Recorder, July 16, 2022.

- Ahmed, Zakir (2022) Govt to implement 9,000 MW of solar projects on a priority basis, Pro Pakistani, August 10, 2022.

- Moving towards solar (2022) Express Tribune, 2 September, 2022.

- Minister for Finance and Revenue chaired a meeting of the ECC (2022) Government of Pakistan, Finance Division, Press Release Number 828, 19 August, 2022.

- The imported LNG is unloaded at the Floating Storage and Regasification Unit (FSRU hereafter), stored and evaporated to natural gas prior to being delivered to Pakistan`s transmission network market. For more on Engro LNG imports contact: Siddiqui, Yusuf at [email protected] and Sabih Shad at sabih. [email protected]

- Stiftung Mercator (2015) Smart urbanization could save up to 25% of energy use by 2050, January 13, 2015.

- Creutzig, Felix; Baiocchi, Giovanni; Bierkandt, Robert; Pichler, Peter-Paul; Seto, Karen (2015) A Global Typology of Urban Energy Use and Potentials for an Urbanization Mitigation Wedge, Proceedings of the National Academy of Sciences.

- Niazi, Zahra (2022) Tackling the energy crisis, The News International. August 30, 2022. Niazi is a researcher at the Center for Aerospace and Security Studies (CASS), Islamabad, Pakistan and can be reached at [email protected]

- Cohen, N. and Nussbaum, B., (2019) Smart is Not Enough: How to ensure the technologies of the future don’t break our cities (and us with them). What is a Smart City? New America, 2019.

- Bagaeen, S., & Uduku, O. (Eds.). (2010). Gated communities: Social sustainability in contemporary and historical gated developments/edited by Samer. London: Earthscan.

- https://www.brecorder.com/news/40201823/rs747trn-target-215pc-growth-in-fy23-revenue-collection-required

- Federal Budget Bulletin (2022-2023) Budget Study Center, Center for Peace and Development Initiatives (CPDI), July 2022.

- https://www.brecorder.com/news/40201823/rs747trn-target-215pc-growth-in-fy23-revenue-collection-required

- Djankov, Simeon (2016). “The Doing Business Project: How It Started”. Journal of Economic Perspectives. 30 (1): 245–250, February, 2016.

- Ramay, Ahmad, Shakeel (2022) CPEC and its execution, The News International, 22 August, 2022.

- Ease of doing business in Pakistan (2012-2020) World Bank and Trading Economics.

- Pakistan’s Constitution (2010) Eighteenth Amendment Act whereby Presidential assent was received on April 19, 2010.

- Long terms Plan (LTP) for China-Pakistan Economic Corridor (2017-2030)

- Ramay, Ahmad, Shakeel (2022) CPEC and its execution, The News International, 22 August, 2022.

- For more on RCEP “What is RCEP and what does an Indo-Pacific free-trade deal offer China?”(2020) South China Morning Post. 15 November 2020 and Ng, Charmaine (2020). “15 countries, including Singapore, sign RCEP, the world’s largest trade pact”. The Straits Times. 15 November 2020.

- Khalid, Ozer (2022) A New Battlefront – South Asian influence and power contests in Central Asian, July 2022. Weekly Report for Criterion Quarterly.

- Abbasi, Jawaria and Salman Aneel (2020) A sustainable ocean-led development paradigm (SODP) for Pakistan, Pakistan Institute of Development Economics, October, 2020.

- Geographically, the coast of Pakistan can be bifurcated into five sections, commencing from the Iran border at Gwatar Bay Westwards stretching all the way up to the Indian border at Sir Creek, Eastward. Pakistan`s major coastline includes the following destinations: Gwadar Coast, Lasbela (Balochistan), Karachi (Port Qasim, Clifton, Karachi`s port offers unencumbered waterfront access to two primary industrial hubs, namely the Export Processing Zone (Landhi) and Korangi Industrial Area), Thatta Coast from Korangi Creek up to Indian border at Sir Creek Rann of Kutch from Badin to Tharparkar Districts. The Balochistan Coast possesses numerous bays encompassing Gwatar Bay (bordering Iran), Gwadar West and East Bays, Pasni Bay and Sonmiani Bay with Miani Hor as its back water lagoon.

- Zafar, Naghmana and Humayun, Asaf (2014) Pakistan`s “Blue Economy”, Potential and Prospects, Policy Perspectives, 11 (1): 57, January, 2014.

- Rehman, Syed., Yanpeng. Cai, Rizwan. Fazal, Gordhan. Walasai, and Nayyar. H. Mirjat. (2017) a. “An Integrated Modeling Approach for Forecasting Long- Term Energy Demand in Pakistan.” Energies 10.

- Basit, Ali and Alam, Ammar (2020) Blue Economy: Pakistan`s untapped potentials, The News International, Jang Group, 29th of July, 2020.

- Ali, Ghulam (2019) China-Pakistan maritime cooperation in the Indian Ocean, Issues Stud, October, 2019.

- Tribune.com.pk (2019) “Imran launches work on mega projects in Balochistan”. The Express Tribune. 29th March, 2019.

- Basit, Ali and Alam, Ammar (2020) Blue Economy: Pakistan`s untapped potentials, The News International, Jang Group, 29th of July, 2020.

- Basit, Ali and Alam, Ammar (2020) Blue Economy: Pakistan`s untapped potentials, The News International, Jang Group, 29th of July, 2020.

- Here the rabbit hole refers to Alice in Wonderland. 2010. [film] Directed by Tim Burton. Disney.