Twitter @OzerKhalid

Instagram @ozer.khalid

e-mail: [email protected]

Abstract

(This paper attempts to analyze some of the remaining thirteen conditions and action items for compliance which the FATF is placing on Pakistan, what has thus far been achieved by Pakistan in terms of satiating FATF`s overall 27 prerogatives and underscores potential scope for improvement with actionable recommendations. – Author)

FATF: A Historical Evolution and Evaluation

In 1989, the G-7 finance ministers established a Financial Action Task Force (FATF), with a Secretariat in Paris, tasked with the ongoing responsibility to develop a robust and coordinated approach in combating Anti-Money Laundering (AML) in their jurisdictions.1

Several nation states became part and parcel of this task force. The FATF has since developed 24 standards (termed and titled Recommendations)2 incorporating model legislation and institutional arrangements attempting to curtail miscreants and money launderers from gaining access to global financial markets.3-4

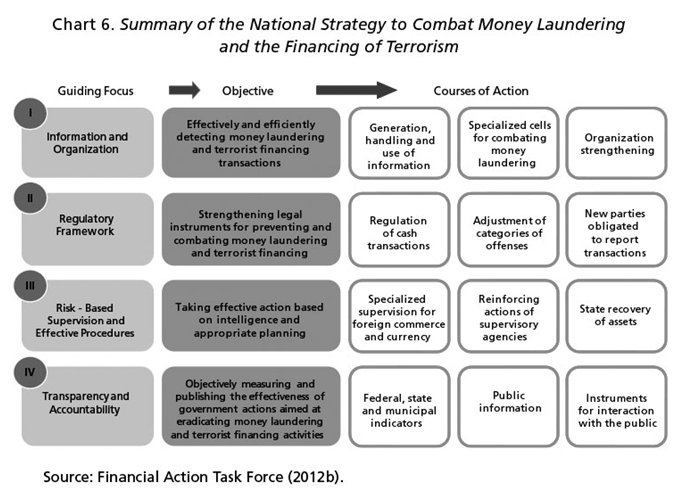

The table below exhibits some key imperatives, objectives and implementable courses of action that FATF seeks from member-states:

In a frenzied and paranoid post 9/11 world, an essential feature of Countering Financing for Terrorism (CFT) was also inserted, and recently addendums pertaining to the proliferation of “weapons of mass destruction”5 have also been added to FATF`s “watch-list”.

Since then, FATF’s “Action Plan” promulgated in February 2018, evolved a set of newer points, inter alia, including6:

- Combatting terrorist financing, including the adoption of a new counter-terrorist financing operational plan and a statement on the actions taken under the 2016 counter-terrorist financing strategy.

- Adoption of a report to the G20 Finance Ministers and Central Bank Governors.

- Updated FATF Guidance on Counter Proliferation Financing.

- Progress reports in addressing the deficiencies identified in its mutual evaluation reports since it agreed an action plan in November 2017.

- Two public documents identifying jurisdictions that may pose a risk to the international financial system:

- Jurisdictions with strategic Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) deficiencies for which a call for action applies.

- Jurisdictions with strategic AML/CFT deficiencies for which they have developed an action plan with the FATF.

- Monitoring Iran’s actions to address deficiencies in its AML/CFT system7.

- Revisions on information sharing to the FATF Methodology.

- Update on recent developments on de-risking.

- Improving the understanding of virtual currencies risks.

- Update on FinTech8 & RegTech Initiatives.

- Improving the effectiveness of the Criminal Justice System: FATF global engagement with judges and prosecutors.

- Outcomes of the meeting of the FATF Forum of Heads of Financial Intelligence Units (FIUs), which was held in the margins of the Plenary.

- Strengthening FATF’s institutional basis.

- Further improving the identification and understanding of terrorist financing risks, both at country level and more broadly, which will have an impact on the effectiveness of international efforts to tackle terrorist financing.

- Carry forward FATF’s work to enhance information-sharing, which will build on the work that FATF has already completed on domestic inter-agency information sharing and sharing within the private sector.

- Ensure that efforts to detect terrorist financing lead to successful investigations, prosecutions and convictions including the President’s initiative on increased engagement with the criminal justice system and prosecution services.

- Ensure a better global implementation of effective counter-terrorist financing measures through closer coordination with FATF’s regional bodies and the actions they are taking.

Pakistan’s compliance on FATF`s 14 Action Points to Pakistan

Pakistan was placed on the “grey list”/watchlist of 2012-2015 with a subsequent referring to a regional supervisory peer group and FATF`s regional body, the Asia Pacific Group (APG), to ameliorate Pakistan’s AMP/CFT regime. Through strategic assistance of the APG, Pakistan came out of the grey list in 2015 for which it was globally acclaimed.

In February 2018 in Paris, FATF developed a “watch-list” that included Pakistan, once again, along with Ethiopia9, Iraq10, Serbia, Sri Lanka11, Syria, Trinidad and Tobago, Tunisia12, Vanuatu and Yemen13.

Pakistan comes under scrutiny due to (amongst others) the unruly activity of malevolent miscreants such as Jaishe-e-Mohammad, ASJW, Jamat-ud-Dawa (JuD) and Lashkar-e-Tayyaba (LeT), Muslim Milli League, insurgency/volatility on the Af-Pak border and shrewd and divisive lobbying and campaign contributions by Modi`s BJP in Paris (HQ of the FATF), Strasbourg and Brussels (EU) and to key U.S. politicians. Since February 2018, Pakistan has been provided with four extensions, the latest of which will culminate in September/October 2020, a deadline extended in lieu of the COVID-19 pandemic.

On the surface, India`s prime concern is the use of Fake Indian Currency Notes (FICN). Indian security agencies are concerned that these FICN`s are produced by sophisticated currency production machines. The notes are smuggled into India creating self-financing espionage and terror networks. Delhi strengthened its FCORD (FICN coordination cell) set up within their Intelligence Bureau. This is on the surface, but probing deeper, Delhi has been deploying back-channel diplomacy and lobbying to get Pakistan “blacklisted” by FATF. Last year, Prime Minister Imran Khan confessed in an interview with Al Jazeera TV that India wanted to bankrupt Pakistan and push it into the FATF blacklist.

During the ongoing Paris plenary, the Indian media, its English language television channels in particular, have been spewing venom, running consistent smear campaigns against Pakistan in an attempt to influence the FATF deliberations and also distract the world from their illegal annexation of Kashmir, controversial citizenship legislation and mounting Islamophobia.

Pakistan undergoes dual scrutiny at the FATF platform. Pakistani authorities are aspiring to cooperate with the International Cooperation Review Group (ICRG) as well as complete the International Country Risk Guide which monitors 140 countries and includes a hundred pages of political, financial and economic risk ratings while working in parallel on the deficiencies highlighted in the Asia Pacific Group`s (APG) Mutual Evaluation Report (MER) for which Pakistan is currently in an “observation period”. Islamabad has every intention to complete all items on the FATF action plan thereby upgrading from the “grey list” to the “white list” in 2020. This will require unprecedented cooperation by LEAs, regulators, federal and provincial governments.

Pakistan has been vigilant in its ongoing war vis-à-vis money- laundering, but we must keep our guards up from all sides to avert further aggressive diplomatic and political lobbying by any neighbouring country to further its geo-political agenda. The time has come to keep stealth enforcing and broadcasting the measures taken by us reflecting our preparedness to deal with the menace of money laundering and terror financing.

Despite all of Islamabad`s noteworthy AML/CFT efforts, there is still a prevailing sentiment at the task force`s headquarters in Paris regarding an “alleged” misuse of the financial environment by proscribed organisations in countries on the FATF watch list which has raised red flags – asking Pakistan to “do more”.

Pakistan’s status has been retained on the FATF’s Compliance Document, commonly referred to as the “grey list”, for five more months, setting September/October 2020 as the new deadline for delivering on the FATF`s pending thirteen compliance action items pertaining to better terror financing risk management. When the Paris plenary session convenes in October 2020 they will assess not only Pakistan`s 27-point Action Plan, but more crucially the thirteen action points where the FATF found Pakistan lacking which will be detailed later in this report.

After piercingly widespread geo-political speculation following March`s Financial Action Task Force (FATF) plenary, there are chances, believe geo-strategists, that Pakistan might officially be placed on the “white-list” in October 2020.

Pakistan’s political commitment has led to progress in a number of areas in its action plan, including risk-based supervision and pursuing domestic and international cooperation to identify cash couriers.

In October 2019 plenary meeting, Pakistan was declared “fully compliant” on five points which are:

(1) Understanding risks of counter financing terrorist (CFT) by the financial sector;

(2) Outreach sessions of Anti Money Laundering (AML) and CFT for the financial institutions;

(3) Developing an integrated database at airports;

Pakistan has achieved noteworthy strides on this point in particular. The menace of illegal travel documents, fake passports, fraudulent movement at immigration vectors and human smuggling ensured that the FIA (empowered by the FIA Act 1974 and Foreigners Registration Act 1964) tightened the entry/exist systems not just at airports but all over.

FIA digitized the arrival/departure of international travelers via an integrated database titled the “Personal Identification Secure Comparison & Evaluation System” (PISCES), a vital tool in combatting terrorism with a standardized Exit Control List (ECL).

(4) Mechanism to publicise designated persons and entities; and

(5) Terrorist Financing (TF) specific units and analysis done by Financial Monitoring Unit (FMU) and State Bank of Pakistan (SBP).

The FATF plenary in February 2020 found Pakistan compliant on an additional 9 points of the remaining points of action so Pakistan was declared compliant on 14 points of the total 27 action points. The FATF had found Pakistan compliant on:

(1) Audit of financial institutions by the State Bank of Pakistan

(2) Suspicious Transaction Reports (STRs) disseminations and analysis done by FMU – in addition to STRs the FMU also reports on Currency Transactions Reports (CTRs) from its designated reporting The FMU launched a data center in 2017 to help automate AML/ CFT intel and can disseminate the Financial Intelligence to the concerned Law Enforcement Agencies (if required) for their further necessary action in this respect. The FMU acts as the country’s face at all international forums related to Anti-Money Laundering & Combating Terrorism financing 14.

In October 2019, FMU launched its first quarterly newsletter and announced that this new initiative aims to ensure that all the stakeholders, including reporting entities, are updated on initiatives being undertaken both at domestic and international levels towards development of AML/CFT standards.

(3) Terror financing risk assessment and its implementation

(4) Inter-coordination mechanism of federal & provincial departments

(5) Parallel investigations by Counter Terrorism Departments (CTDs)

(6) Risk assessment of cash smuggling – especially physical transportation of cash (i.e. bulk cash smuggling (BCS) and cash couriers) to effectively control ML and TF risks in cargo and email.

(7) Implementation of domestic cooperation to counter cash smuggling

(8) Understanding TF by the judiciary through conducting awareness and training session

(9) Risk based outreach of Designated Non-Banking Financial Institutions (DNBFI) and Non Profit Organizations (NPOs)15 – on the regulation and monitoring of NPOs/NGO`s see especially FATF Recommendation 8.

FATF`s Remaining 13 Action Points for Pakistan

Thirteen points still remain of “concern”. The FATF mandated Pakistan to keep submitting progress reports on the stated thirteen action points, whereby compliance to these 13 action points greases the wheels for Pakistan`s exit from the grey list onto an upgraded “white list”.

According to the 36-nation FATF charter, a country must have the support of at least three member states to avoid blacklisting. Pakistan requires 12 votes out of 39 to exit the grey list and move onto the white list. Islamabad must therefore now lobby for tactical votes primarily from EU and GCC Gulf countries. The FATF currently comprises 36 members with voting powers and two regional organisations, representing most of the major financial centres in all parts of the globe.

If progress on the thirteen action points remain lackluster, Pakistan might regrettably remain in the quagmire of the grey list16.

The Asia Pacific Group, conveyed its decision to the Financial Monitoring Unit (FMU established under section 6 of the Anti-Money Laundering Act) for postponement of the Joint Working Group (JWG) meeting for all countries, including Pakistan, scheduled to be held in Beijing in May 2020 due to the outbreak of COVID-19 virus. Instead of May/June, now the face-to-face meeting and plenary meeting is expected to take place in September 2020. This can strategically benefit Pakistan in terms of compliance leeway by extending the period by three months.

In order to now be “white-listed” Pakistan must stringently adhere to the pending thirteen FATF conditionalities (out of 27). Out of the thirteen action items the most notable condition is the prosecution and clamp-down of banned militant outfits and proscribed offenders/persons (PO), for which the list has already been furnished to Pakistan for it to come out of the FATF`s grey list “purgatory”. Pakistan was asked to enhance prosecution and conviction in terrorism financing cases.

The Catch-22 dilemma underlying these militant misfits and proscribed persons is that no matter how many of them are placed under “house arrest”, convicted, jailed, placed on the ECL, irrespective of how many of their dubious bank accounts and assets are frozen and despite their CNIC Identity cards being frozen by NADRA and NOC’s (No Objection Certificates) revoked of their “charity organisations” (de facto illicit fronts for their dubious activities into which they pour their ill-begotten finances), these Hydra-headed 17extremist heathens always find ways to cancerously metastasize and crop out of the heaving woodworks.

Al-Qaeda did not die with Osama bin Laden being taken out. His son Hamza bin Laden was then groomed. ISIS did not end by exterminating Abu Bakr al Baghdadi. Every regional IS chapter (Wilayat) now has terrorists at their helm. It is easy to shoot or drone a person. It is impossible to bomb or drone an idea. For ideas are bullet-proof. Poisonous ideas are often generational and come rearing their ugly heads decades later.

Racism did not end with the Civil Rights legislation in the U.S. The KKK supporters with Tiki torches in Charlottesville are a grim reminder of that reality.

Nonetheless, Islamabad will have to submit its progress report on the thirteen points to a joint working group (JWG) of FATF in September, 202018. The clock is ticking. There are only a few months left for showing adherence and progress on the remaining points to demonstrate that Islamabad is seriously moving towards implementation on FATF conditions.

Out of the 27-point action plan, FATF had so far declared Pakistan “fully compliant” on 14 points. As per the list the remaining 13 points of the 27 action plan are:

(1) Pakistan will have to demonstrate effectiveness of sanctions including remedial actions to curb terrorist financing in the country;

(2) Pakistan will have to ensure improved effectiveness for terror financing of financial institutions with particular to banned outfits (those outfits include Jaish-e-Mohammad, Lashkar-e-Tayyaba and several outfits related to Hafiz Saeed)

(3) Pakistan will have to take actions against illegal Money or Value Transfer Services (MVTS- held in cash or invested in the non- financial sector 19) which act as illegal conduits for fund transfers such as Hundi-Hawala (illicit black market money transfers often via bureaux de changes)

(4) Pakistan will have to place sanction regime against cash couriers (this refers to the natural persons who physically transport currency and BNI on their person or accompanying luggage from one jurisdiction to another).

A BNI is a non-cash monetary instrument which may contain the instruction ‹pay to the bearer›. Common examples of BNIs are cheques, promissory notes, traveler’s cheques, bearer bonds, money orders and postal orders.

Pakistan diligently prepared sectoral risk assessments to identify the risk of cash couriers utilized via air, land and sea for terror financing. Pakistan fully cooperated bilaterally and multilaterally to enforce controls on the illegal movement of currency. Examples of case studies include mis-declarations of containers.

Pakistan has been especially active in this respect along the Pakistan-Afghanistan and Pak-Iran borders (Taftan) exploring the linkages between cash smuggling and transnational terrorist financing networks.

Pakistan initiated a Currency Declaration System (CDS) at all entry/exit points of the country. The FBR also provided access to the FMU to retrieve data of currency declarations and conduct analysis assessments. The FIA will soon offer real-time online access to facilitate passengers at Torkham, Chaman and Taftan. Filling CDS online to file currency declarations will become much easier. Pakistan`s prompt border management system and fencing is required.

Pakistan Customs departments have placed high resolution scanners to foil smuggling of cash currency through all entry/exit points by air, land and sea.

(5) Pakistan will have to ensure logical conclusion from ongoing terror financing investigation of law enforcing agencies (LEAs) against banned outfits and proscribed persons such as Lakhvi and Hafiz Saeed;

(6) Pakistani authorities will have to ensure international cooperation based investigations and convictions against banned organisations and proscribed persons (lists provided to Pakistan);

Such unsavoury persons include, but are not limited to, Lakhvi, Abdullah Ubaid, Malik Zafar Iqbal Shahbaz, Abdul Rehman Abid, and Qazi Kashif Husain.

(7) The country will have to place effective domestic cooperation between Financial Monitoring Unit (FMU) and LEAs in investigation of terror financing;

(8) Prosecution of banned outfits and proscribed persons (list provided to Pakistan);

Such outfits include Lashkar-e-Taiba, Jaish-e-Mohammad and Hizbul Mujahideen.

(9) Demonstrate convictions from court of law of banned outfits and proscribed persons (list provided to Pakistan);

(10) Seizure of properties of banned outfits and proscribed persons (list provided to Pakistan);

(11) Conversion of madrassas20 (academic religious seminaries) to schools and health units into official formations (list provided to Pakistan);

Critics contend and lament that many madrassas encourage extremism21, as analysis of the profiles of suicide bombers who have struck in at least one region of Pakistan have found most attended madrasas22.

(12) To cut off funding of banned outfits and proscribed persons; and

(13) Pakistan will have to place permanent mechanism for management of properties and assets owned by the banned outfits and proscribed persons (list provided to Pakistan)23.

Pakistan and the FATF: The Current Debacle

If Pakistan`s updated and revised action plan on fighting terrorism financing “does not deliver” in September/October 2020, there is a small chance that Pakistan may be put on FATF’s “black-list” which would unnerve the country’s economy, especially in a COVID-19 addled world.

All this anti-Pakistan lobbying strikes a few policy-makers as an odd diplomatic coup against Islamabad given Pakistan`s amended Anti- Terror Act 1997, beefed up Finance Bill 2018, FMU, AML 2010, and a plethora of complementary regulations assisting the country to critically curb money laundering under mutual assistance agreement with the OECD and other countries.

India overtly, but many states in the international community silently feel that Pakistan needs to arduously ramp up efforts related to Anti- Money Laundering (AML) and Combating Financing for Terrorism (CFT), and Islamabad still has to “do more” before the meeting in October, 2020 to avoid the blemished banner of being “black-listed”.

The FATF rightly requires Islamabad to be harsher on Lashkar- e-Taiba (LeT), the Jamat-ud-Dawa (JuD) and the Falah-e-Insaniat Foundation (FIF), Muslim Milli League (MML) entities which were on the United Nations Security Council’s (UNSC) sanction list as per resolution number 126724 (a terrorist linked listing and information sharing process)25.

In lieu of the United Nations Security Council’s (UNSC) sanction list resolution number 1267, Pakistan amended its Anti-Terrorism Act (ATA), in order to decisively take firmer action vis-à-vis the Lashkar-e- Taiba (LeT), the JuD, the FIF, Jaish Muhammed and Hizbul Mujahideen. Pakistan has ensured the implementation of UNSC’s resolutions putting LeT, JuD, FIF, ISIS, al-Qaeda and other groups on the terror watch-list.

In key consultation with a multitude of stakeholders, a checklist was prepared by the Government of Pakistan, to place tougher tabs on LeT, JuD and FIF.

Regarding the anti-terror crackdown, dubious characters linked with LeT, JuD and FIF have officially been declared as “proscribed offenders” under the terror laws pursuant to section 11-EE of the Anti-Terrorism Act 1997, and include the notorious Hafiz Muhammad Saeed26, Abdullah Ubaid, Malik Zafar Iqbal Shahbaz, Abdul Rehman Abid, and Qazi Kashif Husain.

All the properties belonging to Jamaat-ud-Dawa (JuD) and its charity arm, the Falah-e-Insaniat Foundation (FIF), have been confiscated in Azad Jammu and Kashmir (AJK) and Gilgit-Baltistan (G-B), and its` 148 properties/assets (including immovable assets, hospitals, dispensaries27) were also confiscated in Islamabad and Punjab during the ongoing crackdown against the twin organisations28.

The confiscated assets of JuD and FIF constitute a tidy sum of Pak Rs 96 million. Authorities also froze the bank accounts of the JuD, FIF and LeT; freezing exactly 121 bank accounts under the UNSC Resolution-1267, containing deposits worth $100 million.

The above includes 69 bank accounts containing Rs10.97 million of JuD, LeT and FIF of concerns (19 accounts) and associated individuals (50 accounts)”. Pakistani banks vamped up their “Know Your Customer” (KYC) policies, especially for “Politically Exposed People” (PEPs).

Pakistan also has frozen accounts of proscribed individuals listed on the 4th Schedule of the ATA, 1997 in accordance with section 11-O of this law. Under this action, 5,094 bank accounts having Rs157.235 million have been frozen29.

Pakistan created Counter Financing of Terrorism Units (CFTUs) to keep tabs on the “financial” aspect of the investigation in money laundering, terrorist financing, assets tracing and other necessary skills. Pakistan’s authorities also initiated strict action to prevent collection of hides by such entities, via registering 438 cases against individuals throughout the country in 2018.

With their assets sealed, bank accounts frozen, passports of suspected JuD, FIF, LeT militants cancelled and their weapons’ licenses revoked by the Interior Ministry, they have crucially been circumvented from raising funds and spreading cross-border terror.

The cyber presence of all these terror outfits remains a menace and were highlighted to Pakistan at the FATF Bangkok summit. To tackle this head-on, Pakistan`s Telecommunication Authority (PTA) developed an e-portal system to file complaints against the misuse of the internet for the purposes of terrorism and it`s financing.

Initially, the FIA Cyber Intelligence Wing, blocked 41 URLs associated with LeT, JuD and FIF thus preventing the entities from raising funds online. Islamabad has requested France and USA to block these websites “at source” in their jurisdictions30 however, action from their end is still awaited.

In this regard, Washington and Paris can ill-afford to be lax, as over 52 secured web pages (i.e. web content hosted on “https” protocols e.g. YouTube, Facebook, and Twitter etc.) 31 were identified by PTA which cannot be blocked at an individual URL level; rather the whole website has to be shut down.

Therefore, support from social media behemoths will be needed in the ongoing challenge that remains online cyber security and surveillance.

However, crucial delays in notifying anti-money laundering authorities related to certain amounts of tax evaded money is a piercing thorn that needs to be solved. In this regard, a Statutory Regulatory Order, SRO 611 was published on June 9th, 2016 which entitled the Directorate General Intelligence and Investigation (DG I&I) of the Federal Board of Revenue to commence action against individuals who might be implicated in laundering tax-evaded money.

The Lahore High Court alarmingly, in January 2018, struck down this notification on the request of the federal cabinet which has since forwarded this issue for legal review. The Federal Cabinet`s delaying the implementation of SRO 611 on prosecuting tax evaded money, hampering the government`s remaining corpus of robust anti-money laundering framework. Such delay tactics do the Government no favours as the FATF will now micro-analyze every issue.

In addition, Pakistan`s Legal decisions such as a Pakistani court overturning the death sentence of Ahmed Omar Saeed Sheikh, the murderer of Wall Street Journal reporter Daniel Pearl32, and three others who had been sentenced to life in prison brought Pakistan unnecessary negative publicity. Furthermore, Lahore courts delaying cases pertaining to the notorious Jamat-ul-Dawah head honcho, Hafiz Saeed, do not augur well.

Such unilateral maneuvers may influence FATF members to vote to further restrict the country’s access to the international financial system by either keeping it on the “grey list” or devolving it to the dreaded “black-list”.

Pakistan – AML and CFT Laws – A critical review

Pakistan promulgated a comprehensive AML/CFT regime which, de jure, should more than satisfy the FATF, but de facto, does not, as analysts contend that power politics are at play.

Pakistan encountered monumental obstacles in evolving a globally acceptable and palatable AML-CFT regime, yet it`s efforts are often met with thanklessness. Such is the pulse and sentiment of most law-abiding average Pakistanis.

Pakistan initially enacted a 2007 Ordinance; however, the final Anti- Money Laundering Act was approved in 2010 under the nomenclature of the AML Act, and very specifically detailed under the Schedule of Predicate Offences in the AML Act, 2010.

Islamabad`s Parliament enacted this ‘stand-alone legislation’ on Anti-Money Laundering (AML) to tackle all three stages of money laundering from “placement” (in banks and related accounts) to “layering” (moving through several banks and jurisdictions) through to “integration” into the wider financial markets (reinforced via additional transactions). The 2010 AML Act is a monumental legal milestone.

Under the AML of 2010, a set of crimes, legally labeled “predicate offenses” carry the offense of money laundering, punishable by up to 10 years of imprisonment with the confiscation of all crime proceeds (both moveable and immovable assets).33

The legal onus of charging and prosecuting the offenders of “predicate offenses” resides with the bodies administering, monitoring and evaluating such laws. An effective legal measure is a layered system of “prevention” forbidding the flow of “stained dirty money” through the sensitive valves of Pakistan`s financial arteries.

The FMU is mandated to receive, analyse and disseminate Suspicious Transaction Reports (SRTs) and Currency Transaction Reports (CTRs) and, in case of finding any suspicious activity, the body may immediately generate Suspicious Activity Reports (SARs) which are sent to four federal agencies: NAB, ANF, DG II of FBR and FIA. Accuracy and comprehensiveness of AML Act 2010 can be gauged from the fact that the Act includes different offences previously mentioned in six different Acts, making it a more encompassing legislative measure.

To bolster AML, Pakistan set up a Financial Monitoring Unit (FMU) under the Ministry of Finance, housed within the premises of the State Bank of Pakistan (SBP).

The FMU has been designed with the unique mandate of receiving, analyzing and disseminating Suspicious Transaction Reports (STRs) and Currency Transaction Reports (CTRs).

Applicable laws now require financial institutions (and some chartered professional organizations) to furnish full reports on suspicious transactions to an operationally independent FMU under the 2010 AML law. If the FMU has reasons to suspect that the transaction may be “proceeds from a crime”- it is filed under Suspicious Activity Reporting (SAR).

After due diligence and scrutiny, the FMU decides to share the Suspicious Transaction Report (STR) with multiple relevant agencies (intelligence, law enforcement and tax) tasked with taking cognizance of the predicate offense.

Investigative powers of AML/CFT have been conferred to four federal law enforcement agencies, notably: the National Accountability Bureau34, Anti-Narcotics Force, Directorate General (Investigation and Intelligence) wing of the Federal Board of Revenue35 and Federal Investigation Agency36”.

These accountability, investigation and enforcement agencies subsequently perform inquiries, investigation and (when required) prosecute culpable offenders. Another report prepared by the FMU is a Currency Transaction Report (CTR), which monitors, tracks and traces the movement of cash beyond a prescribed threshold.

The 2010 AML law institutes a comprehensive architecture for the investigation and prosecution of AML offenses, stipulates on the courts of jurisdiction and other procedural norms.

Banks, financial institutions and competent authorities file STRs and CTRs wherever suspected activities are linked to the AML Act, 2010. The identity cards (CNIC) and National Tax Numbers (NTN) of every suspect is duly recorded and shared with competent authorities.

Gradually, the Government of Pakistan (GoP) enacted a myriad of related reforms/measures harmonizing other legislation to align with anti-money laundering and counter terrorist financing across multiple laws.

For example, the Schedule of Predicate Offences, under the AML Act, 2010 was revised to include additional offences from the following Laws/Acts:

- Pakistan Penal Code, 186037

- Prevention of Corruption Act, 194738

- Foreign Exchange Regulations Act, 1947

- Customs Act, 1969

- Securities Act, 201539

- Sales Tax Act, 1990

- Federal Excise Act, 2005

- Income Tax Ordinance, 2001

More recently, the Finance Bill 2018 and related legislation also helped Pakistan curb and contain money laundering under mutual assistance agreements with the OECD and other countries.

Pakistan`s Anti-Terrorist Act (ATA) 199740 initially did not address the topic of financing for terrorism. However, the ATA (Second Amendment) Act, 201441, bridged this gap by adding a new offense – providing financial support to culprits engaging in terrorist activities.

The Ordinance amending the 1997 Anti-Terrorism Act and putting Hafiz Saeed’s Jamaat-ud-Dawa (JuD) and Falah-i-Insaniat Foundation (FIF) (their charity wing) on the nation`s banned list – a decision that was a decade delayed and long overdue in my opinion – are essential steps in the right direction. However, as highlighted earlier, lax behavior by certain courts in Lahore have partially dampened these efforts.

Implementing AML-CFT is an extraordinary undertaking requiring multiple levels of training and skill-development workshops prior to establishing an effective regime.

Obviously, for ordinary law enforcing agencies such as the local police and constabularies, the AML/CFR task remains Herculean, often due to resource deficit, but is progressing at a steady pace.

Forensically investigating a financial “bread-crumb trail” and nabbing culprits necessitates considerable effort, resources, wherewithal and capacity building. The financial resources needed to accomplish this task is often sorely underestimated and lacking.

In Pakistan, the FMU delivers regular training (albeit for now on a limited scale), whereas special cells have been established in provincial IG offices to follow up cases involving AML offenses. Several countries, most notably Australia, have offered such training facilities to Pakistan’s law enforcing officers.

FATF Grey-Listing – Ramifications for Pakistan

Economically, some argue, that Pakistan`s FATF grey-listing may not impact Pakistan as sorely as the Cassandra doom-and-gloom pundits would have you believe, but the political shockwaves and reverberations will be more intense.

FATF grey listing compels Pakistan to take an (even) tougher stance on countering extremism, which, over the long haul, will only benefit Pakistan and her citizens.

Despite showing meaningful progress, especially by cracking down on Hafiz Saeed and the three outfits linked to him, as a last-ditch effort to avoid falling into the dreaded FATF “watch-list” in June, 2018, FATF asserted that Islamabad needed to do more and to conjure up a new “comprehensive action plan”.

FATF grey listing will make life especially tougher for Pakistani expatriates and overseas citizens who send significant remittances. Any amount they currently send exceeding USD $ 100,000 will be flagged by the State Bank of Pakistan (SBP). Regressing to the FATF`s black- list will imply hellish North-Korean type sanctions.

Post potential blacklisting even more trivial remittances would come under judgmental radar. Grey listing created bureaucratic hurdles on remittances which will nauseatingly amplify for many, this is especially tough as most funds are bona fide and urgently needed (for medical treatment of relatives in Pakistan during the COVID-19 pandemic, etc).

Some economists reasoned that the grey-listing will squash Pakistan’s economy, rendering it harder for Pakistan to meet her surging foreign financing needs and downgrading the country`s debt ratings, which in turn would make Pakistan less creditworthy in the eyes of credit rating agencies, international lenders, investors, borrowers, traders and speculators.

Over the long-haul grey listing makes it more arduous for Pakistan to tap into the international capital and fixed income markets.

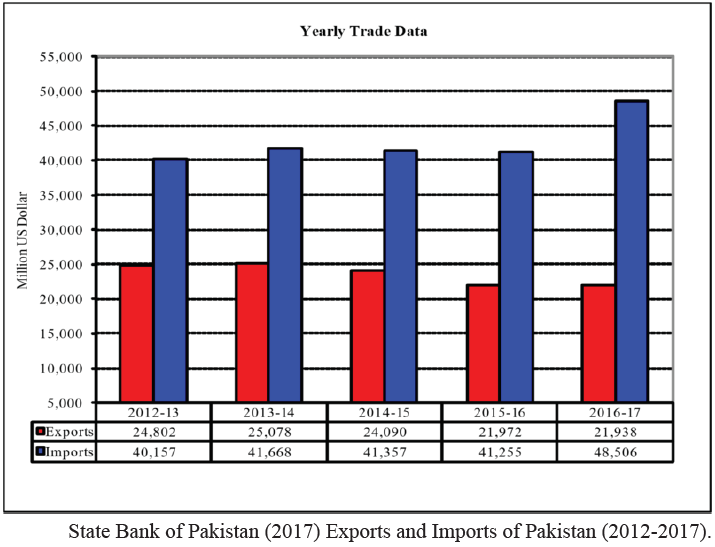

However, a deeper and more sobering analysis, both past and present, factually also proves otherwise. Pakistan was already FATF grey-listed from 2012 to 2015, yet during that time-period it`s stock market cumulatively increased 3% higher.

As already noted above, from 2012-2015 Pakistan efficaciously completed an IMF EFF program and raised over $5 billion from the international fixed-income markets.

During the same period Pakistan’s imports and exports performed with stability (as visualized hereunder) and, contrary to popular belief, did not raise gargantuan barriers to trade.

Pakistan`s FATF grey listing eclipses a lot of recent positive news, for instance, that the EU has extended its GSP+ facility offering trading relief and rebates to exports, especially in the textile sector.

FATF grey-listing impact is also reduced as Pakistan has already issued Sukuk (Islamic) bonds worth millions of dollars, secured credit and loans from international capital markets, and successfully negotiated loans with, but not limited to, the IMF, World Bank, EU, the Asian Development Bank and received a consistent flow of foreign remittances, especially from the Gulf region.

Malaysian, Qatari, Saudi, Japanese, Turkish corporations and Egyptian property tycoons have also heavily poured money into Pakistan`s infrastructure and real estate.

The aforementioned, by no means signals a lazy carte blanche advocating that Pakistan twiddles it`s thumbs or rests on its laurels. The FATF’s verdict is one of many current political storms brewing in Islamabad`s over-flowing teacup.

Since warming the seats at the White House, Trump`s administration has undertaken every concerted effort to coerce and arm-twist Pakistan into ending links with non-state extremists such as the inflammatory and infamous Haqqani Network. Initially, Islamabad might have, mistakenly, reacted nonchalantly to this shift in policy and perilously released Hafiz Saeed from house arrest.

The major strategic paradigm shift that transpired during the current FATF talks was that previous allies, China and Saudi Arabia, strategic partners that mostly backed Islamabad, have patently indicated that they will “not” unconditionally stand by Pakistan.

Therefore, more fluid, ever-changing diplomatic paradigm shifts should be expected. For instance, Islamabad`s rapprochement with the Kremlin, Tehran (not willing to seal the border with Taftan urgently after COVID-19) and the Central Asian Republics (CAR`s) can be witnessed. Moscow has its eyes peeled on certain key assets in Pakistan, including Bank al Falah, and is reportedly “in the market” for deep- seated acquisition sprees.

Pakistan`s security establishment, especially after the APS tragedy and meaningful counter-terrorism campaigns and IBO`s such as Sirat al Mustaqeem, Zarb-e-Azb and Radd-ul-Fassad, encouragingly recalibrated strategic imperatives, and no longer take “outsized risks” with militants.

Especially after the FATF machinations, a debate among some Pakistani analysts deepens on questioning the country’s security and foreign policy, whilst acknowledging a more “transactional” relation between Islamabad and Washington based on “calculated and pre- meditated” interests.

A Roadmap for the Future – Recommendations

It is worthwhile to remember that FATF`s grey-listing is not only due or down to terror financing, as full conformity with FATF also requires meaningful compliance with the OECD`s Base Erosion and Profit Shifting (BEPS) standards, which endeavor to curb tax avoidance strategies that exploit gaps and mismatches in tax rules to artificially shift profits to low or no-tax shelters, as was witnessed during the Paradise Leaks.

Under the OECD`s BEPS inclusive framework, over 100 countries and jurisdictions are collaborating. In this regard Pakistan`s Federal Board of Revenue (FBR) can play an instrumental role.

Islamabad can further integrate systems and processes to strategically align with the OECD`s new global standard on Automatic Exchange of Information (AEOI) which reduces the potential for tax evasion. It provides for the exchange of cross-border “non-resident financial account information” with the tax authorities in the account holders’ country of residence.

Participating jurisdictions that implement AEOI send and receive pre-agreed annual information, without having to send a specific request. AEOI ingeniously enables the discovery of previously undetected tax evasion and unearths concealed assets and prompt voluntary disclosures.

It can enable the FBR to recover essential tax revenue lost to errant non-compliant taxpayers and will boost global initiatives pertaining to transparency, cooperation, and accountability. As new information reveals itself the OECD`s existing protocol of Exchange of Information on Request (EOIR) will also amplify, working in complementarity.

Pakistan`s FBR can also play a transformative role to clamp down on transfer pricing (another tax evasion technique) and tax havens42.

Irrespective of the FATF outcome, Pakistan should seek technical compliance re-rating from FATF Paris, to keep abreast of their latest requirements, Key Performance Indicators (KPI`s) and a scorecard of how Pakistan is improving.

Islamabad can regularize routine reporting to the FATF Forum of Heads of Financial Intelligence Units (FIUs) (which hold the margins of the Plenary) with (at least) quarterly updates that include the latest intelligence debriefs with AML and CFT regulatory updates and emerging fintech and regtech developments in our ever-evolving knowledge-based digital economy – including crypto-currencies and the perils and potential of virtual currency risks.

For instance, recently Pakistan has been at the very forefront of such legislation – banning the trading of major crypto-currencies such as Bitcoin, deeming them too “risky”. Bitcoin and other currencies are currently deployed by terrorists to finance their operations on the sinister deep and dark web.

Collectively, Pakistan`s SBP, FBR, FIA, NAB and Finance Ministry can collectively share information, develop innovations for de-risking and de-leveraging and co-create working papers dealing with “deficiencies identified and lessons learnt in AML, CFT and KYC” and submit them to the FATF – informing their mutual evaluation report43.

Legal bodies and the law ministry may bolster the effectiveness of an ever-evolving Criminal Justice System, whereby our Judges and Prosecutors can routinely outreach and engage with relevant FATF personnel. This will safeguard and streamline aligned initiatives to detect terrorist financing culminating in forensically detailed investigations and produce a higher rate of successful prosecutions and convictions.

Pakistan can more frequently and consistently depute senior bureaucrats, financial stakeholders, compliance personnel and bankers to actively partake in FATF workshops especially at the FATF Training and Research Institute in Busan, Korea. This would not only further enhance the identification and comprehension of emerging terrorist financing risks at national, regional and international levels, but also refine the efficiency of global initiatives to combat ominous terrorist financing.

Concluding Remarks

Macroeconomic realities of Pakistan in 2020 such as surging external and fiscal imbalances44, a current account deficit, a precipitous drop in foreign exchange reserves, and heightened risks to Pakistan’s economic and financial outlook due to COVID-19 affect its medium- term debt sustainability.

It is paramount to note Pakistan’s overall current economic health, where our current account deficit straddles between 6-7% of GDP and our manufacturing sector is already beset by negative growth rate with a decline rate of 3.4% in the first seven months of 2019-2020. The agriculture sector has witnessed a 10% fall in cotton output; the transportation sector has seen a decline of 11% in the consumption of diesel; export orders have been cancelled45; and this is just a brief outlook of our economic conditions amid the COVID-19 crisis. This will hugely impact our lackluster growth rate, which may remain at 1.5% for the fiscal year 2019-20 but even that remains uncertain. Against this background of rising external and fiscal financing needs and declining reserves, risks to Pakistan’s medium-term capacity to repay the World bank, IMF, EU will increase46.

Pakistan`s global reputation, true long-term social counter extremism change and environment and fiscal sustainability47 resides in containing the debt conundrum, fixing the balance of payments issues, propping up foreign currency reserves and attracting Foreign Direct Investment (FDI) and improving the FATF benchmarks – all of which are inter-linked.

The financial cushions by the Asian Development Bank, IMF and World Bank are a transient bandage on much deeper wounds, and to grow lax or lethargic over the upcoming FATF requirements is fiscal folly, especially during these time-sensitive deadline-driven months. Pakistan cannot wish away it`s grey-listing status nor can it afford global isolation. If Pakistan regresses from the “grey” to the “blacklist” the difficulty of interfacing with multilaterals along with the negative PR, difficulty in securing investment and global alienation will be too heavy a burden to bear.

Bibliography

Khalid, Ozer “A Nation`s Soul with Sabika (2018), Express Tribune available at https://tribune.com.pk/story/1716392/6-nations-soul-sabika/ published 23 May, 2018.

Khalid, Ozer (2017) “Trouble in Paradise”, Express Tribune, November 21, 2017.

Shah, Saeed (2020). “Pakistani court overturns murder conviction in killing of Wall Street Journal Reporter”, Wall Street Journal, 2 April, 2020.

Tokar, Dylan (2020) “Pakistan removes thousands of names from Terrorist Watch List”, Wall Street Journal, April 20, 2020.

India Today (2020) Covid-19: “Pakistan Court indefinitely adjourns hearing against Hafiz Saeed in terror financing cases” Press Trust of India, Lahore, April 15, 2020.

Elias, Davidson (2017) The Betrayal of India: Revisiting the 26/11 Evidence (First Edition, 2017), Pharos.

United Nations Security Council resolution 1267 (1999) was adopted unanimously on 15 October 1999.

UN Resolution 1267: Diaz, William (2011) “Dualist, but not divergent: evaluating United States Implementation of the 1267 Sanctions Regime”, 5 Liberty U. L. Rev. 333, 341 , 2011.

Gannon, Kathy (2001) “Giving up Bin Laden could destroy the Taliban”. The Guardian. London, 1 September, 2001.

Statement by the FATF President (2020): Covid-19 and measures to combat illicit financing, Paris, 1 April 2020.

Chris Holland, Felicia Marie and Maya Deering (2019) “Non-Face-to-Face-KYC Explained”. Holland & Marie. 10 August 2019

Roberts, Gregory (2016) FinTech Spawns RegTech to Automate Compliance, Bloomberg, (June 28, 2016)

Fund for Peace (2017) «What Methodology Was Used for the Ratings? | The Fund for Peace». fsi.fundforpeace.org. on 2017-09-04

The New Humanitarian (2019) “Tipping points 2019 | Lessons from fragility”. The New Humanitarian. 2019-04-10.

Ansari, Irshad (2020) “FATF gives Pakistan time until October to exit grey list, Express Tribune, February 21, 2020.

Haider, Mehtab (2020) “FATF extends deadline to Pakistan”, April 8, 2020, The News International, Jang Group.

Ogden, Daniel (2013) Drakon: Dragon Myth and Serpent Cult in the Greek and Roman Worlds. Oxford University Press.

Piccardi, Luigi (2005) The head of the Hydra of Lerna (Greece). Archaeopress, British Archaeological Reports, International Series N° 1337/2005, 179-186.

Haider, Mehtab (2020) “Pakistan must comply with 13 points to come out of FATF grey list”, The News International, Jang Group, March 2020.

Booth, R., et al., (2011) Money laundering law and regulation: A practical guide. First Published, Oxford University Press.

Hiro, Dilip (2012) Apocalyptic Realm: Jihadists in South Asia. Yale University Press.

Tavernise, Sabrina (2009). “Pakistan’s Islamic Schools Fill Void, but Fuel Militancy”. New York Times, May 3, 2009.

Hyat, Kamila (2008). “No room for doubt and division”. The News International. September, 25, 2008.

Financial Monitoring Unit (2019) Newsletter «Quarterly Newsletters issued by Financial Monitoring Unit». 30 October 2019.

IMF (2020) “World Economic Outlook Database, April 2020”. International Monetary Fund. Retrieved 17 April 2020.

Agency, Anadolu ( 2019) “IMF bailout package — rescue or trap for Pakistan?”, May 16, 2019.

Woods, Ngaire (2014) The globalizers: the IMF, the World Bank, and their borrowers (Cornell UP, 2014).

Pakistan Bureau of Statistics (PBS) (2020) at: http://www.pbs.gov.pk/ress-releases Castellum AI website at https://www.castellum.ai/

Business Recorder (2020) URL at https://www.brecorder.com/

Social Science Research Network (2019) Fiscal Sustainability: A Historical Analysis of Pakistan’s Debt Conundrum. Emerging Markets: Theory & Practice eJournal. Social Science Research Network (SSRN). Accessed 1 July 2019.

Javed, Salman (2020) “Covid-19, FATF and Pakistan”, The Nation,. April 11, 2020.

Gulf News (2019) “Pakistan growth to hit eight-year low as IMF bailout looms”. 2019.

Brzozowski, Alexandra (2020) “Belgium extends COVID-19 lockdown by two weeks until 19 April”. EURACTIV. 27, March, 2020.

Cameron, Dell (2017) “Today’s Massive Ransomware Attack Was Mostly Preventable; Here’s How To Avoid It”. Gizmodo.

The Express Tribune (2017) «Shadow Brokers threaten to release Windows 10 hacking tools».

Thomas P. Bossert (2017). «It›s Official: North Korea Is Behind WannaCry». The Wall Street Journal. 18 December 2017.

Jakub Kroustek (2017) “Avast reports on WanaCrypt0r 2.0 ransomware that infected NHS and Telefonica”. Avast Security News. Avast Software, Inc. 12 May, 2017.

Chohan, Usman W. (2019) “The FATF in the Global Financial Architecture: Challenges and Implications”. International, Transnational & Comparative Law Journal. UNSW Business School; Critical Blockchain Research Initiative (CBRI); Centre for Aerospace & Security Studies (CASS). 14 March, 2019.

Janjua, Karen (2018) FATF: One shade of grey, fifty explanations and excuses, The Express Tribune, June 30, 2018.

Anadolu Agency (2020) Pakistan eyes removal from FATF grey list, Anadolu Agency, February 19 (2020)

Pakistan remains in FATF`s Grey list, could slip back to black list after (2020) ABP News Bureau, 21 February 2020.

Namrata Biji Ahuja (2020) Will Pakistan move out of Grey List? Crucial FATF plenary at Paris, The Week, February 16, 2020.

Global terrorist-financing watchlist (2018) Reuters, Feb 14, 2018

Khan, Waqar Masood (2018) Anti-Money Laundering and terrorist financing, Pakistan Today, February 17, 2018.

Outcomes of the FATF Plenary, 21-23 February (2018), Paris, France.

Hanif, C.M., (1996) The Pakistan Penal Code 1860, (Act no. XLV of 1860) : up-to- date and exhaustive latest commentary, Lahore : Lahore Law Times Publications, 1996, 2 volumes, p 1639.;

Ahmed, N (2013) ‘The Dark Side of Authority: A Critical Analysis of Anti-Corruption Framework in Pakistan’ 2013 (2) Law Social Justice and Global Development Journal (LGD).

Anti-Terrorism Act (1997) (No. XXVII of 1997

Anti-terrorism (Second Amendment) Act, 2014 (VII of 2014)

Anti-terrorism (Amendment) Act, 2014 (VI of 2014) and the Express Tribune (2018), Grey-listing by FATF does not affect Pakistan’s ability to borrow money: IMF deputy director, March 11, 2018.

Hindustan Times (2018) Grey listing over terror financing won’t affect Pakistan’s ability to borrow from IMF, Wadhington, March 11, 2018,

Younus, Uzair (2018) “How will being on the FATF grey-list actually impact Pakistan”, The Diplomat, The Pulse, March 01, 2018.

Tanoli, Qadeer (2018) FATF grey list: 148 properties of JuD, FIF confiscated in Punjab, Express Tribune, Islamabad, March 8, 2018.

Gishkori, Zahid (2018) FATF asks Pakistan to come up with new action plan by June 8, The News, Jang Group, 26 May, 2018.

Notes of the meeting held at the Pakistan Institute for Parliamentary Services (PIPS) Hall, in May, 2018.

Monitoring Report (2018) Govt holds-up in notifying anti-money laundering powers, Prrofit section in Pakistan Today, May 7, 2018.

Müller Sebastian R. (2006) Hawala – An Informal Payment System and Its Use to Finance Terrorism by Müller, December 2006.

«Counter-Terrorism, «Policy Laundering,» and the FATF: Legalizing Surveillance, Regulating Civil Society» (2015) The International Journal of Not-for-Profit Law. The International Journal of Not-for-Profit Law.

Robert Mazur (2010) “Banking on Terror”. Huffington Post. November 4, 2010.

David Bagley, Phillipp von Türk (2011) «The Wolfsberg Group Comment Letter on FATF Standards Review January 2011», January 6, 2011.

FATF Grey Listing (2018) A Direct and Immediate Impact, The Economic Times.

References

- Pakistan remains in FATF`s Grey list, could slip back to black list after (2020) ABP News Bureau, 21 February 2020.

- Khan, Waqar Masood (2018) Anti-Money Laundering and terrorist financing, Pakistan Today, February 17, 2018.

- Namrata Biji Ahuja (2020) Will Pakistan move out of Grey List? Crucial FATF plenary at Paris, The Week, February 16, 2020.

- Ahmed, Khurshid (2020) Pakistan stays on FATF terrorism financing “gray list”, Arab News, February 21 (2020).

- A term which gained credence during 2003`s botched and bungled up invasion of Iraq.

- Outcomes of the FATF Plenary, 21-23 February (2018), Paris, France.

- Iran`s status also importantly regains relevance, given the recent U.S. revocation of the JCPOA and a potential new spate of sanctions. In light of the Trump administration`s recent revocation, Tehran officially stated that it will continue pursuing “uranium enhancement”.

- “Fintech” is a discipline at the cutting-edge intersection of finance and technology.

- The terrorist group Al-Shabaab, although hedonistically head quartered based in Somalia, poses a menace across the entire East African region. Ethiopia, reeling from wars with Eritrea, in 2017 witnessed explosions at the Florida International Hotel in Gondar from a grenade assault and two separate explosions at hotels in Gondar and Bahir Dar.

- Iraq is still not out of the dangerous woods, wrought by weak governments such as those of Maliki, remains infested with the vestiges of ISIS.

- Terrorism be deviling SriLanka is vastly typified as“ethno-nationalist terrorism” with militants such as the Liberation Tigers of Tamil Eelam (LTTE) and Janatha Vimukthi Peramuna (JVP) which are mainly wreaking havoc on Sri Lanka`s largely tourism dependent economy.

- Tunisia is often targeted by ISIS due to their tolerant “secular” Al-Nahda government. The infamous Bardo attacks also killing foreigners springs to mind.

- Yemen`s Ambassador to Islamabad told this author that every few minutes a child is killed or dies from malnutrition in Yemen, beset by one of the worst humanitarian crisis to date.

- Financial Monitoring Unit (2019) Newsletter «Quarterly Newsletters issued by Financial Monitoring Unit». 30 October 2019.

- Mehtab, Haider (2020) “Pakistan must comply with thirteen points to come out of the FATF grey list”, The News International, Jang group. March, 2020.

- Haider, Mehtab (2020)“Pakistan must comply with 13 points to come out of FATF grey list”, The News, Jang Group.

- The Lernaean Hydra often known simply as the Hydra, is a serpentine water monster in Greek mythology. Hydra metaphorically refers to a snake has many heads, which keep cropping up and multiplying, no matter how many you cut or an organization multiple (often shadowy) organisations and sub-divisions. For more: Ogden, Daniel (2013). Drakon: Dragon Myth and Serpent Cult in the Greek and Roman Worlds. Oxford University Press.Piccardi, Luigi (2005). The head of the Hydra of Lerna (Greece). Archaeopress, British Archaeological Reports, International Series N° 1337/2005, 179-186.

- Haider, Mehtab (2020) “FATF extends deadline to Pakistan”, April 8, 2020, The News International, Jang Group.

- Booth, R., & others. (2011). Money laundering law and regulation: A practical guide. First Published, Oxford University Press.

- Most madrasas in Pakistan are Deobandi, Sunni. For more consult: Hiro, Dilip (2012). Apocalyptic Realm: Jihadists in South Asia. Yale University Press, especially page 162.

- Tavernise, Sabrina (2009). “Pakistan’s Islamic Schools Fill Void, but Fuel Militancy”. New York Times, May 3, 2009.

- Hyat, Kamila (2008). “No room for doubt and division”. The News International. September, 25, 2008.

- Mehtab, Haider (2020) “Pakistan must comply with thirteen points to come out of the FATF grey list”, The News International, Jang group. March, 2020.

- The Sanctions List at present has the names of 257 individuals and 82 entities and was last updated on 9 May 2018, which supersedes all previous versions. The sanctions list mostly includes ISIL (Da’esh) & Al-Qaida names. The UN Committee co-operates with INTERPOL to conjure up an INTERPOL- United Nations Security Council Special Notices for listed individuals, groups, undertakings and entities. These notices promote information sharing and implementation of anti-terrorism measures among and between Member States.

- Tanoli, Qadeer (2018) FATF grey list: 148 properties of JuD, FIF confiscated in Punjab, Express Tribune, Islamabad, March 8, 2018.

- Recently released by a Lahore High Court verdict.

- Pakistan`s Red Crescent had been directed to take over seven ambulances associated with the Falah-e-Insaniat Foundation (FIF).

- As confirmed to a Senate panel by Pakistan`s interior secretary, Arshad Mirza, during a meeting held at the Pakistan Institute for Parliamentary Services (PIPS) Hall, in May, 2018. The meeting was chaired by Senator Rehman Malik.

- As reported by Gishkori, Zahid (2018) FATF asks Pakistan to come up with new action plan by June 8, The News, Jang Group, 26 May, 2018 as well as other documents disclosed by GEO TV.

- Gishkori, Zahid (2018) FATF asks Pakistan to come up with new action plan by June 8, The News, Jang Group, 26 May, 2018.

- Ibid.,

- Shah, Saeed (2020). “Pakistani court overturns murder conviction in killing of Wall Street Journal Reporter”, Wall Street Journal, 2 April, 2020.

- Khan, Waqar Masood (2018) Anti-Money Laundering and terrorist financing, Pakistan Today, February 17, 2018.

- Also known as the “Ehtesab” Committee.

- A Federal tax collecting institution.

- Including, for cyber or more recently crypto currency crime, it`s renowned cyber security wing.

- Hanif, C.M., (1996) The Pakistan Penal Code 1860, (Act no. XLV of 1860): up-to-date and exhaustive latest commentary, Lahore : Lahore Law Times Publications, 1996, 2 volumes, 1639 p.;

- Ahmed, N (2013) ‘The Dark Side of Authority: A Critical Analysis of Anti- Corruption Framework in Pakistan’ 2013(2) Law Social Justice and Global Development Journal (LGD).

- The Securities Act (2015) which replaces the 1969 Securities and Exchange Ordinance,

- Anti-Terrorism Act (1997) (No. XXVII of 1997

- Anti-terrorism (Second Amendment) Act, 2014 (VII of 2014) see also the Anti- terrorism (Amendment) Act, 2014 (VI of 2014)

- For a deeply comprehensive take on Pakistan with relation to transfer pricing, BEPS and other OECD regulatory requirements consult: Khalid, Ozer “Trouble in Paradise”, Express Tribune, November 21, 2017.

- Iran`s status also importantly regains relevance, given the recent U.S. revocation of the JCPOA and a potential new spate of sanctions.

- Following significant fiscal slippages in 2017, the fiscal deficit is expected at 5.5% of GDP in 2018.

- Javed, Salman (2020) “Covid-19, FATF and Pakistan”, The Nation, April 11, 2020.

- Hindustan Times (2018) Grey listing over terror financing won’t affect Pakistan’s ability to borrow from IMF, Wadhington, March 11, 2018,

- Social Science Research Network (2019) Fiscal Sustainability: A Historical Analysis of Pakistan’s Debt Conundrum. Emerging Markets: Theory & Practice eJournal. Social Science Research Network (SSRN). Accessed 1st July 2019.